|

*️⃣

Fwd: 🌟 🔑, Unlock Your Creatorland Superpower: Your Profile!

From: Brian Freeman CEO Creatorland <hi@newsletter.creatorland.com>

Date: Fri, Dec 6, 2024 at 5:51 PM

Subject: 🌟 🔑, Unlock Your Creatorland Superpower: Your Profile!

To: royfang@m-commerce.com <royfang@m-commerce.com>

2️⃣

Fwd: Banking meets FinTech: Standard Chartered inks a_major_deal_with_Wise_🏦🤝📱;_FIS’s_Q3_2024:_core_b anking dominanc...

From: Linas Beliūnas from Linas's Newsletter <linas@substack.com>

Date: Sun, Nov 10, 2024 at 17:01

Subject: Banking meets FinTech: Standard Chartered inks a major deal with Wise 🏦🤝📱; FIS’s Q3 2024: core banking dominanc…

To: <royfang@m-commerce.com>

Banking meets FinTech: Standard Chartered inks a major deal with Wise 🏦🤝📱; FIS’s Q3 2024: core banking dominance and digital transformation power growth 🏦📈You're missing out big time... Weekly Recap 🔁

👋 Hey, Linas here! Welcome back to a 🔓 weekly free edition 🔓 of my daily newsletter. Each day I focus on 3 stories that are making a difference in the financial technology space. Coupled with things worth watching & most important money movements, it’s the only newsletter you need for all things when Finance meets Tech. If you’re not a subscriber, here’s what you missed this week:

As for today, here are the 2 awesome FinTech stories that were changing the world of financial technology as we know it. This was yet another good week in the financial technology space so make sure to check all the above stories. Banking meets FinTech: Standard Chartered inks a major deal with Wise 🏦🤝📱The news 🗞️ In yet another signal of growing cooperation between traditional banking and FinTech, Standard Chartered has announced a strategic partnership with cross-border payments giant Wise. The deal will enable Standard Chartered to offer enhanced multi-currency money transfers across Asia and the Middle East, leveraging Wise's established payments infrastructure. Let’s take a look at this and see why it matters. More on this 👉 The partnership will integrate Wise's technology into Standard Chartered's SC Remit service, allowing customers to transfer money in 21 currencies, including major ones such as USD, EUR, GBP, SGD, HKD, and JPY. A key feature of this integration is the promise of mid-market exchange rates without markups, combined with near-instantaneous transfer speeds. Stables, anyone? 👀 ICYMI: This deal represents an expansion of an existing relationship between the two companies, following their earlier partnership in March 2024 through Standard Chartered's Hong Kong-based digital bank, Mox. The announcement had an immediate positive impact on Wise's market performance, with its shares rising 8.5% in London trading. Zoom out 🔎 The partnership's significance is underscored by Wise's impressive operational metrics. The company currently holds over 65 licenses globally and maintains six direct connections to payment systems, enabling 63% of its cross-border transfers to be completed within 20 seconds. In the quarter ending September 2024, Wise processed £35.2 billion ($45.7 billion) in cross-border payments, marking a 20% year-over-year increase. Solid! 👏 ✈️ THE TAKEAWAYWhat’s next? 🤔 At the core, this partnership could mark a turning point in how traditional banks approach FinTech collaboration. Rather than developing competing solutions internally, as some banks like HSBC $HSBC have attempted, Standard Chartered's approach suggests a pragmatic shift toward leveraging existing FinTech infrastructure. For Wise, this partnership could catalyze similar deals with other major banks. Having a Tier 1 global bank like Standard Chartered as a partner significantly enhances Wise's credibility in the institutional banking sector. This is particularly noteworthy given Wise's historical stance of criticizing traditional banks' transfer fees and services. Looking ahead, the next steps for banks will be to embrace crypto innovation, the first of which will be leveraging stablecoins as both an asset and another rail. ICYMI: FinTech giant Wise is a trillion-dollar money mover in the making 😳💸 [unpacking the most important H1 FY25 numbers, what they mean & what’s next for Wise]

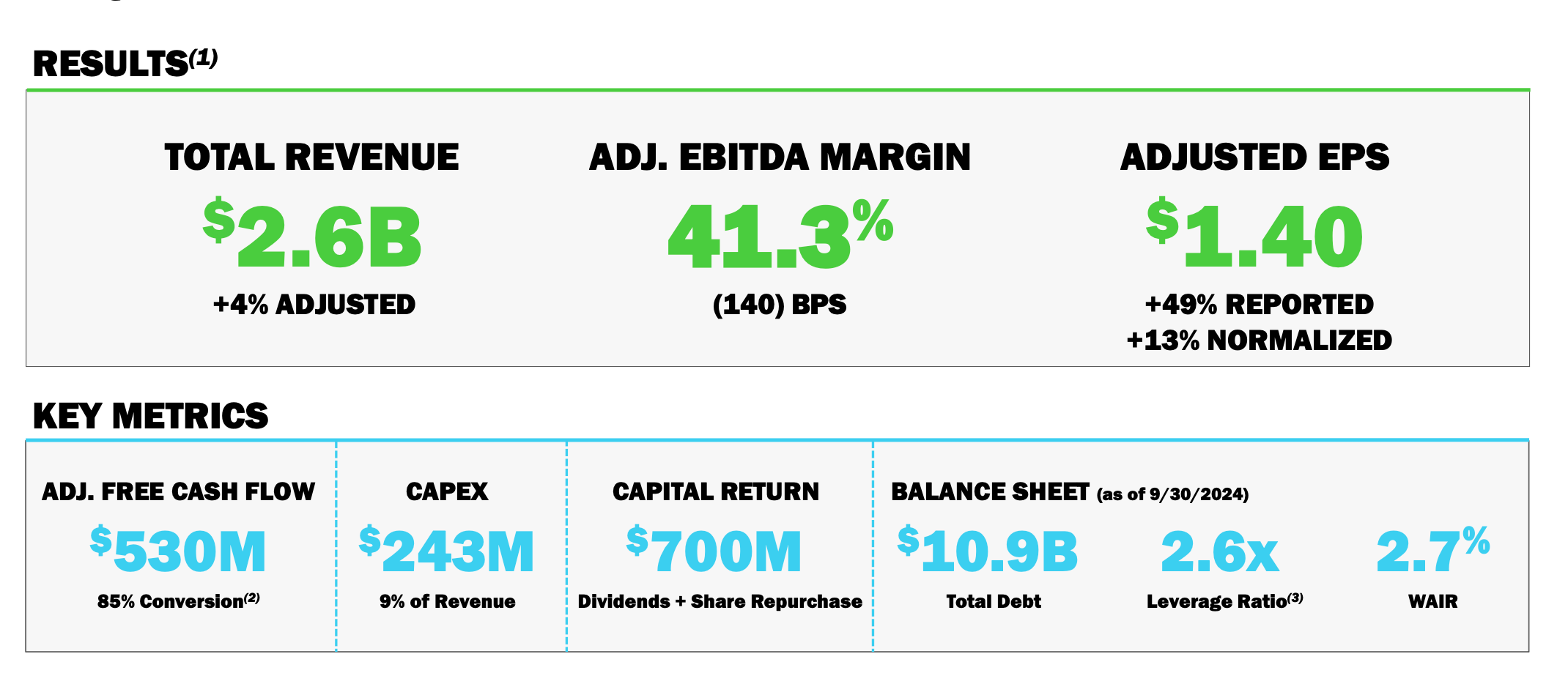

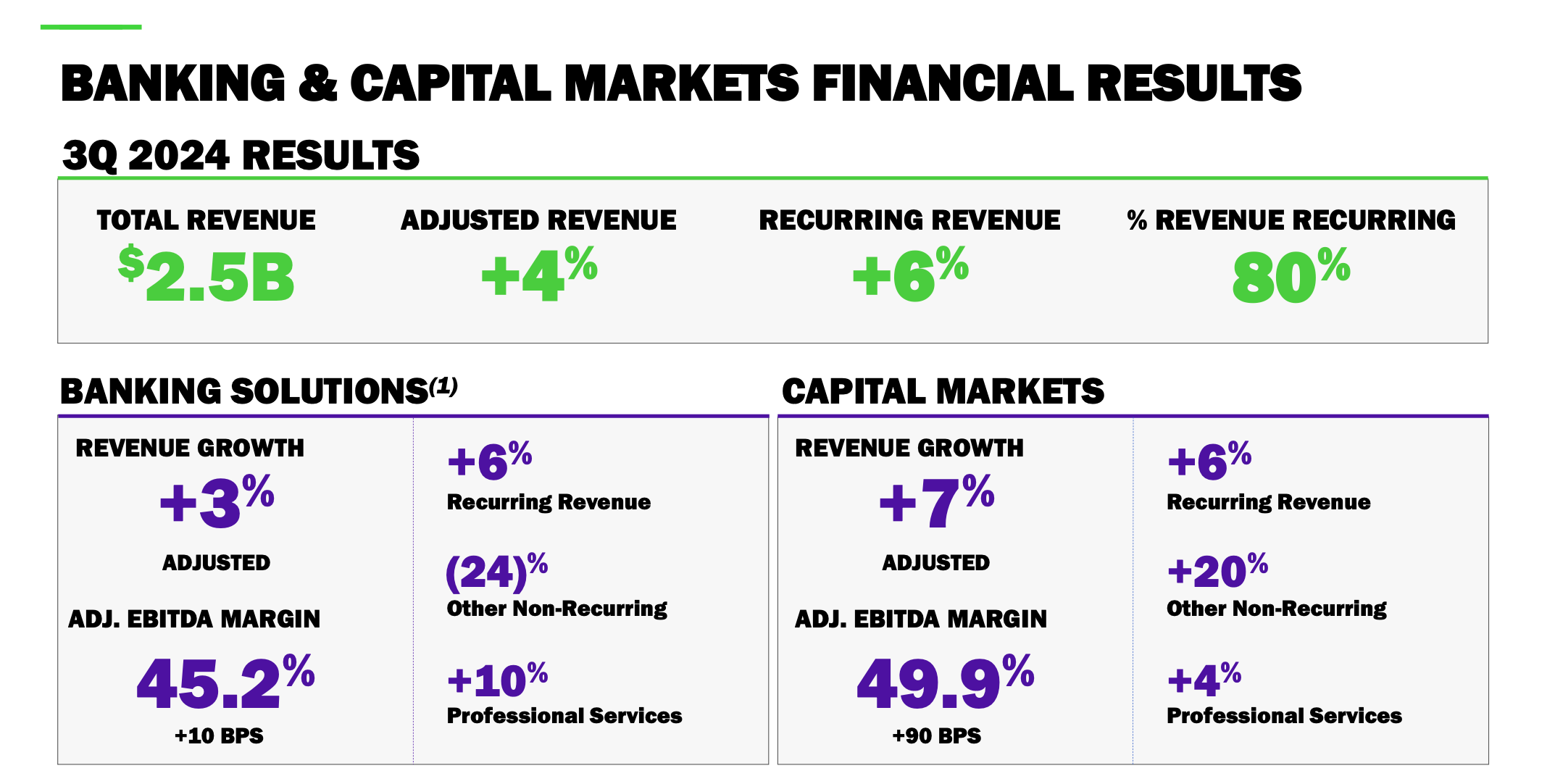

FIS’s Q3 2024: core banking dominance and digital transformation power growth 🏦📈Earnings time 🤑 In the third quarter of 2024, Fidelity National Information Services aka FIS $FIS delivered robust financial performance beating analyst estimates. Let’s look at the key numbers, what they mean, and whether FIS is worth your time and money in 2024. More on this 👉 Key facts & figures:

Zoom out 🔎 FIS continues to show market leadership and scale. One of the key things here is the dominant position in core banking technology with high barriers to entry. Mission-critical systems thus create sticky, long-term customer relationships. Additionally, a broad product suite across the money lifecycle enables powerful cross-selling, and strong recent wins across core banking platforms illustrate that well (IBS, Horizon, MBP). Another noteworthy thing is revenue quality. 80% recurring revenue provides stability and visibility while accelerating recurring revenue growth shows fundamental strength. Furthermore, the premium Payback loyalty solution is gaining significant traction while international expansion opportunities, particularly in APAC look promising for future growth. Finally, we have to speak about capital returns. FIS is now on track for a $4B share repurchase in 2024, which is very solid. Additionally, giving the company $700M returned to shareholders in Q3 alone while having a 35% dividend payout target demonstrates a commitment to shareholders. Risks & Challenges🛡️ Obviously, all of this isn’t without the risks. Here’s what we should be thinking about in the years to come:

Future outlook 🔮 Given the company's strong market position, accelerating recurring revenue growth, and robust capital return program, FIS presents a compelling risk/reward at current levels. The company's adjusted revenue growth guidance of 4.1-4.4% and EPS growth of 16-17% (normalized) demonstrate solid execution of its strategy. ✈️ THE TAKEAWAYWhat’s next? 🤔 All in all, while margin pressures and rising costs are concerning, these appear largely temporal rather than structural. FIS’s ability to expand segment-level margins while investing in growth initiatives is encouraging. Looking ahead, FIS appears well-positioned for sustained growth over the medium term, driven by:

Target 5-7% organic revenue growth and 100-150bps annual margin expansion by 2026, suggesting potential for 12-15% annual EPS growth. Key monitoring points include recurring revenue growth sustainability, margin progression, and competitive positioning in core banking modernization. More importantly, the transformation to a focused banking and capital markets technology provider following the Worldpay separation should drive multiple expansion as execution continues to improve. Disclaimer: this isn’t investment advice and you should always do your own research. ICYMI: Global Payments is set for margin expansion, but near-term growth headwinds warrant caution 👀📈 [breaking down their latest financials, what they mean, and whether Global Payments is worth your time and money in the years to come + more bonus reads inside] Payoneer: a hidden FinTech giant accelerating B2B cross-border payments growth 😤🚀 [breaking down their latest Q3 2024 financials, what they mean, why I’m bullish & why you should be too] Adyen’s Q3 2024: premium payments player hits growth speed bump, but long-term thesis remains intact 🫡📈 [see how premium payments player hits growth speed bump and why long-term thesis remains intact + more bonus reads inside] 🔎 What else I’m watching

💸 Following the Money

👋 That’s it for today! Thank you for reading and have a relaxing Sunday! And if you enjoyed this newsletter, invite your friends and colleagues to sign up: You're currently a free subscriber to Linas's Newsletter. For the full experience, upgrade your subscription. |

3️⃣/

Fwd: SEO is dying, GEO is taking over!

From: Matt Leitz <support@botbuilders.com>

Date: Sat, May 31, 2025 at 12:49

Subject: SEO is dying, GEO is taking over!

To: <royfang@m-commerce.com>

1️⃣/

Fwd: 網站讓她多了 3 成客戶?!最後一晚報名直播🔥

From: Cindy架站趣 <cindy@ycindy.tw>

Date: Tue, May 20, 2025 at 5:15 AM

Subject: 網站讓她多了 3 成客戶?!最後一晚報名直播🔥

To: <RoyFang@m-commerce.com>

|

前幾天和心理諮商師 Janice 聊天,她的網站已經上線一年多了。 她一開始其實沒有太在意數據,因為平常諮詢很忙,沒時間去統計。 而且她的網站只放了 2 篇文章, 要知道,心理諮商的潛在客戶通常會觀望很久才行動, 這也是我一直強調的—— 品牌網站不只是好看,更是讓陌生人願意採取行動的工具。 📌 明天就要直播了! 這場直播,我會手把手解析 👉 還沒報名的朋友,現在是最後的機會! 這次直播,可能就是妳邁向「讓客戶主動找上門」的關鍵一步 ❤️ 我們明天見! Cindy |

Unsubscribe | Update your profile | 113 Cherry St #92768, Seattle, WA 98104-2205 |

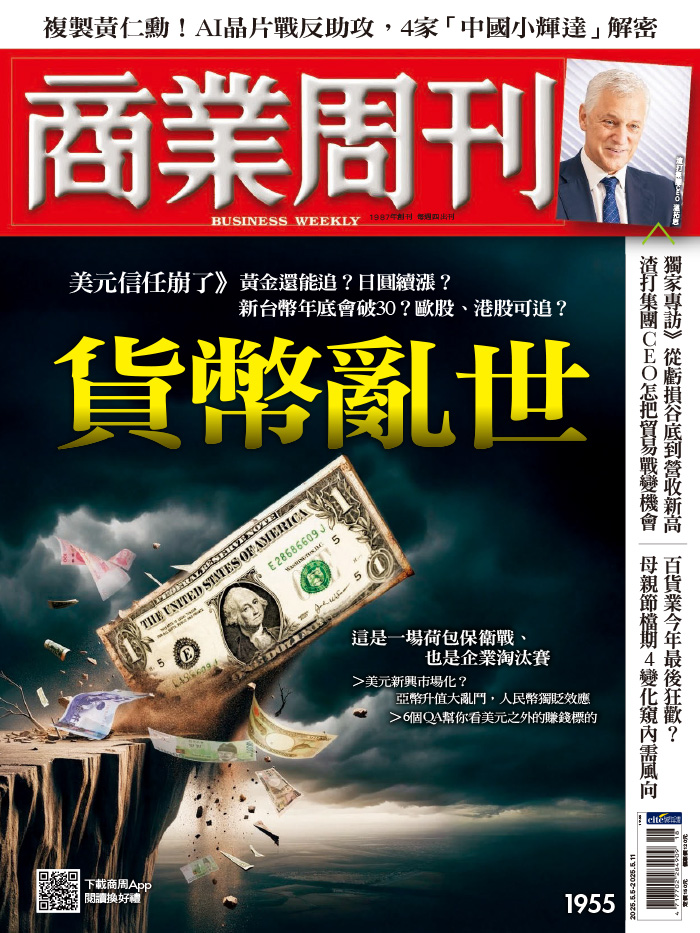

Fwd: 幣值之亂的必勝之道

From: 商業周刊 <bwnet@businessweekly.com.tw>

Date: Thu, May 1, 2025 at 12:27

Subject: 幣值之亂的必勝之道

To: <royfang@m-commerce.com>

|

|||||||||||||||||||||||||||||

|

|

|||||||||||||||||||||||||||||

|

|||||||||||||||||||||||||||||

|

|||||||||||||||||||||||||||||

|

|||||||||||||||||||||||||||||

|

|||||||||||||||||||||||||||||

|

Fwd: 🦾 Secret AI Experiment Outsmarts Humans

From: TAAFT - There's An AI For That <hi@mail.theresanaiforthat.com>

Date: Wed, Apr 30, 2025 at 08:09

Subject: 🦾 Secret AI Experiment Outsmarts Humans

To: royfang@m-commerce.com <royfang@m-commerce.com>

|

2️⃣/

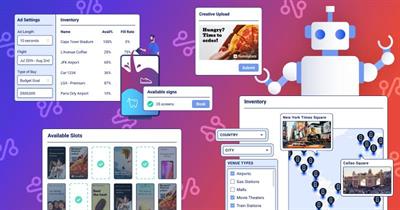

Fwd: ⚡From product URL to stunning ads in seconds

From: Tanmay @ predis.ai <hello@predis.ai>

Date: Wed, Apr 30, 2025 at 06:01

Subject: ⚡From product URL to stunning ads in seconds

To: <royfang@m-commerce.com>

|

|

|

2️⃣/

Fwd: AI Pitch Decks Raise $650M (Q1 2025)

From: New Economies <neweconomies@substack.com>

Date: Mon, Apr 28, 2025 at 20:00

Subject: AI Pitch Decks Raise $650M (Q1 2025)

To: <royfang@m-commerce.com>

AI Pitch Decks Raise $650M (Q1 2025)These startups have raised $650 million in just the past few months

Welcome back to another edition of NEW ECONOMIES, rooted in my experiences working in venture. From inside the venture world, one thing is clear: we’re not just in a tech boom—we’re living through a full-blown economic rewrite. Join us on this journey—subscribe to NEW ECONOMIES to stay ahead of the curve in technology. We’re just getting started. New platforms, new business models, and evolving public market strategies are reshaping everything. NEW ECONOMIES is primarily reader-supported, with additional support from select sponsors. Stay on top of the latest technology trends and help sustain our work by subscribing—free or paid. Your money goes directly towards reporting costs. THIS WEEK’S SPONSOR: ATTIOAttio is the CRM for the AI era. Connect your email, and Attio instantly builds your CRM—with every company, every contact, and every interaction you’ve ever had, enriched and organized. You can also build AI-powered automations and use its research agent to tackle some of your most complex business processes, freeing you to focus on what matters the most: building your company. Join industry leaders such as: Flatfile, Replicate, Modal, Union Square Ventures and more. Try the CRM that’s built for the future—it’s the perfect tool to help you manage your customers, investors and network.

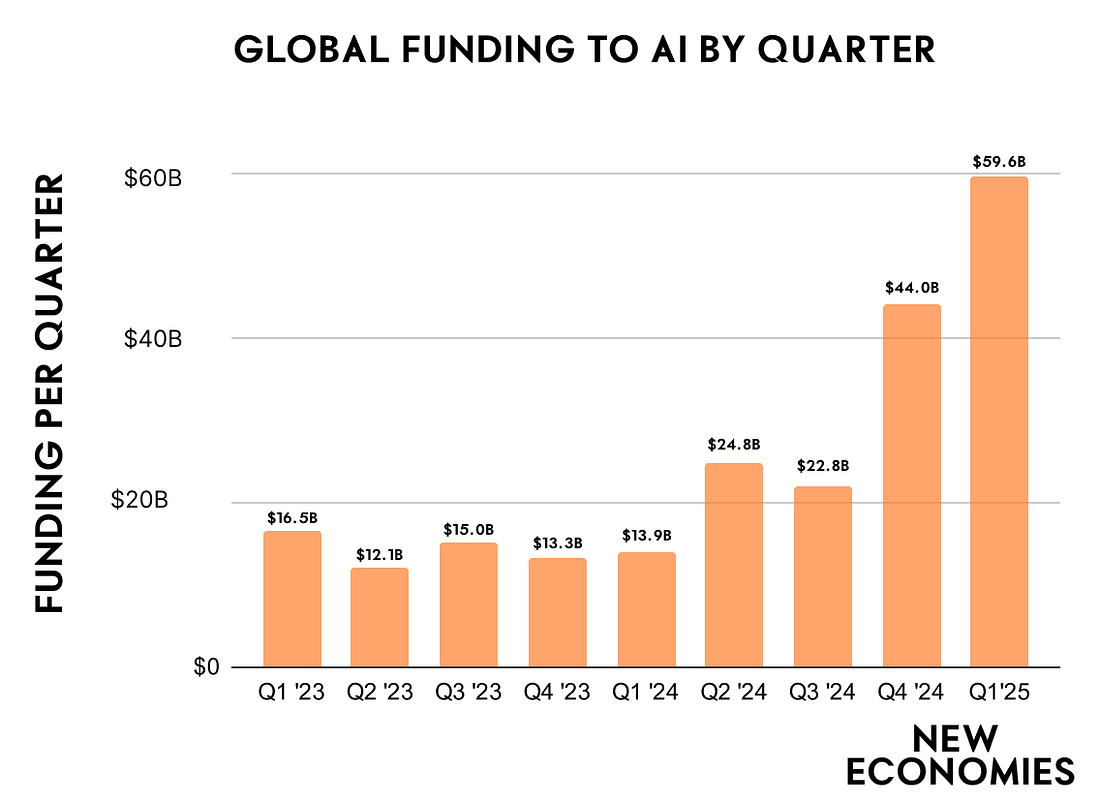

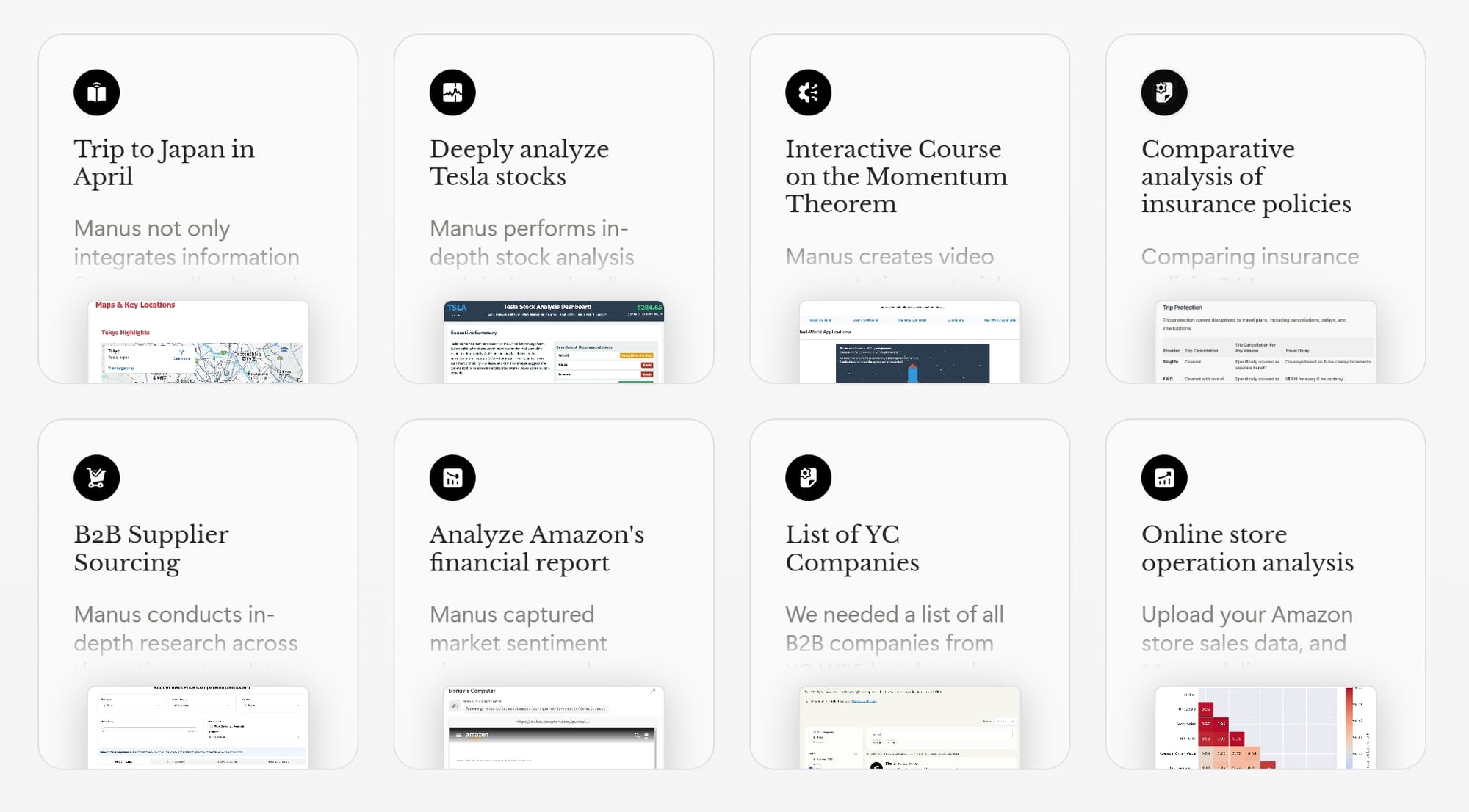

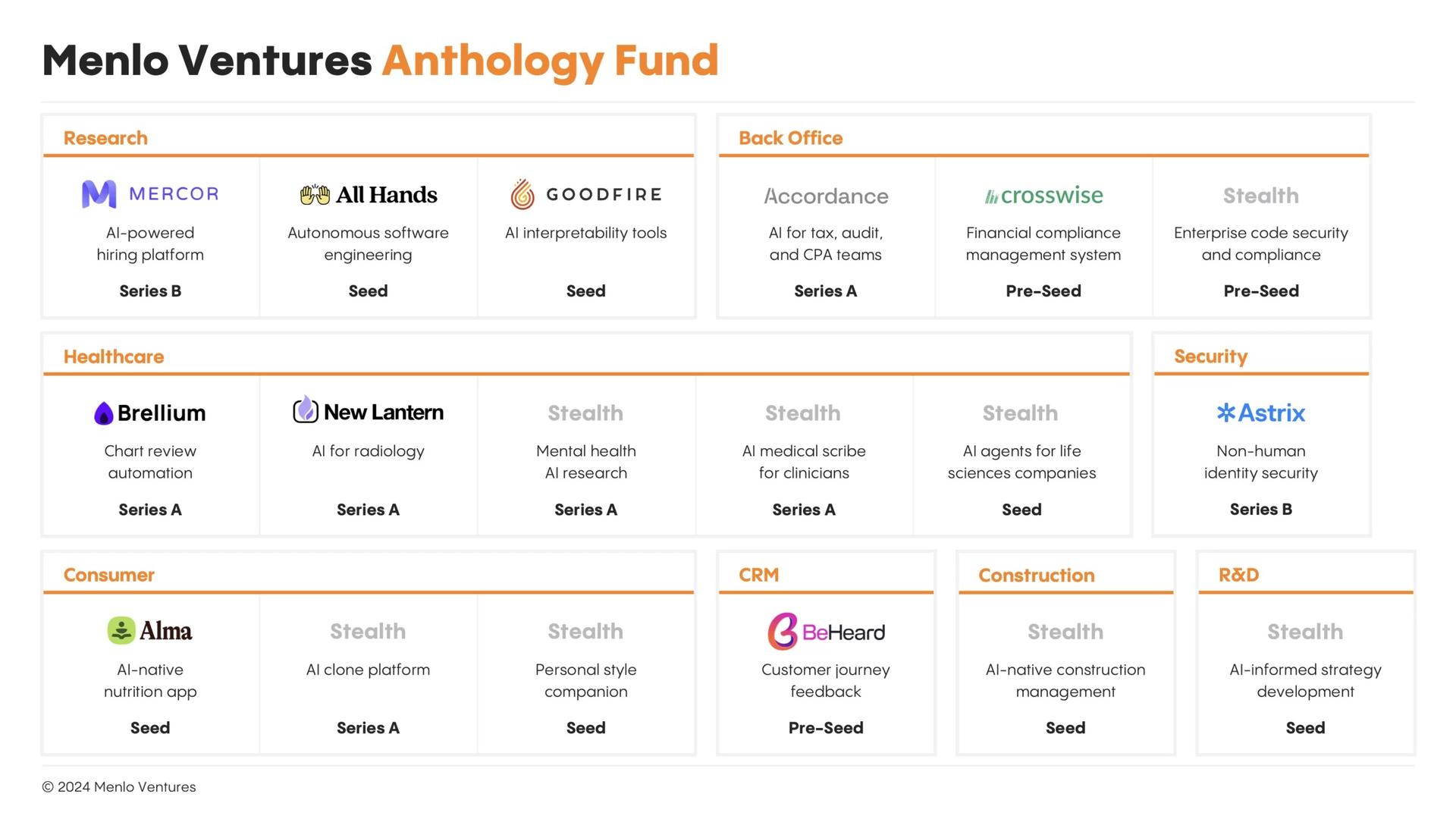

AI IS FLOURISHINGAI funding has reached an all-time high, with nearly $60 billion invested in the category during the first quarter of this year. The momentum shows no signs of slowing down, as companies are hitting record milestones faster than ever—reaching $100 million in ARR with just a handful of team members. You could be next, and to help you, we have 30+ pitch decks from AI startups who have raised over $650M alone this year. These 30 AI startups have just raised $650M—all within the last few months!To help you navigate the startup journey, we’re sharing 30 pitch decks from AI startups that have collectively raised over $650 million in recent months. You'll get an inside look at how they structured their decks, what they included, and how they successfully raised. The startups include:

UPGRADE YOUR NEW ECONOMIES SUBSCRIPTION FOR IMMEDIATE ACCESS TO ALL PITCH DECKS. NOW IS THE TIME TO BUILD, AND THIS IS YOUR OPPORTUNITY TO LEARN FROM STARTUPS THAT HAVE RECENTLY RAISED MILLIONS. IT’S A NO-BRAINER.If you're enjoying reading New Economies, help this edition reach more readers by clicking ❤️ and 🔄 at the top of this post... Subscribe to NEW ECONOMIES to unlock the rest.Become a paying subscriber of NEW ECONOMIES to get access to this post and other subscriber-only content. A subscription gets you:

© 2025 Ollie Forsyth |

2️⃣/

Fwd: Flex Acquires A16z-Backed Maza for $40M

📣/X0000200/2️⃣/

From: Marcel <connecting-the-dots-in-fintech@ghost.io>

Date: Mon, Apr 28, 2025 at 10:01 AM

Subject: Flex Acquires A16z-Backed Maza for $40M

To: <royfang@m-commerce.com>

|

2️⃣/

Fwd: Have you got ‘AI shiny object syndrome’?

From: Darius Lukas <team@dariuslukas.com>

Date: Mon, Apr 28, 2025 at 03:03

Subject: Have you got ‘AI shiny object syndrome’?

To: Roy <royfang@m-commerce.com>

|

|

2️⃣

Fwd: Dcard 搜尋熱詞 × 品牌號廣告實戰,行銷人必讀!

From: Dcard Ads 廣告顧問團隊 <dcard_ads@dcard.cc>

Date: Fri, Apr 25, 2025 at 16:03

Subject: Dcard 搜尋熱詞 × 品牌號廣告實戰,行銷人必讀!

To: <RoyFang@m-commerce.com>

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

2️⃣

Fwd: Anthropic Unveils New AI Model of welfare!

From: Open Pedia AI <openpedia@mail.beehiiv.com>

Date: Fri, Apr 25, 2025 at 01:46

Subject: Anthropic Unveils New AI Model of welfare!

To: royfang@m-commerce.com <royfang@m-commerce.com>

|

2️⃣

Fwd: 4x4.ai, you can now walk your Splats with one click!

📣/X0000200/2️⃣/

From: Arrival.Space Team <hello@arrival.space>

Date: Mon, Apr 7, 2025 at 10:55 PM

Subject: 4x4.ai, you can now walk your Splats with one click!

To: 4x4.ai <royfang@m-commerce.com>

|

2️⃣

Fwd: What Does AGI Look Like?

From: AI Secret <newsletter@aisecret.us>

Date: Fri, Mar 7, 2025 at 19:09

Subject: What Does AGI Look Like?

To: <royfang@m-commerce.com>

|

2️⃣

Fwd: [Secret project] New SketchWow AI

From: Jason at SketchWow <support@sketchwow.net>

Date: Wed, Mar 5, 2025 at 10:06 PM

Subject: [Secret project] New SketchWow AI

To: Fang KuoChun <royfang@m-commerce.com>

|

2️⃣

Fwd: Google's Free AI Makes Data Science a Breeze! 🌬️

From: Joshua Clear <aiweeklydotcom@mail.beehiiv.com>

Date: Wed, Mar 5, 2025 at 3:29 PM

Subject: Google's Free AI Makes Data Science a Breeze! 🌬️

To: royfang@m-commerce.com <royfang@m-commerce.com>

|

2️⃣

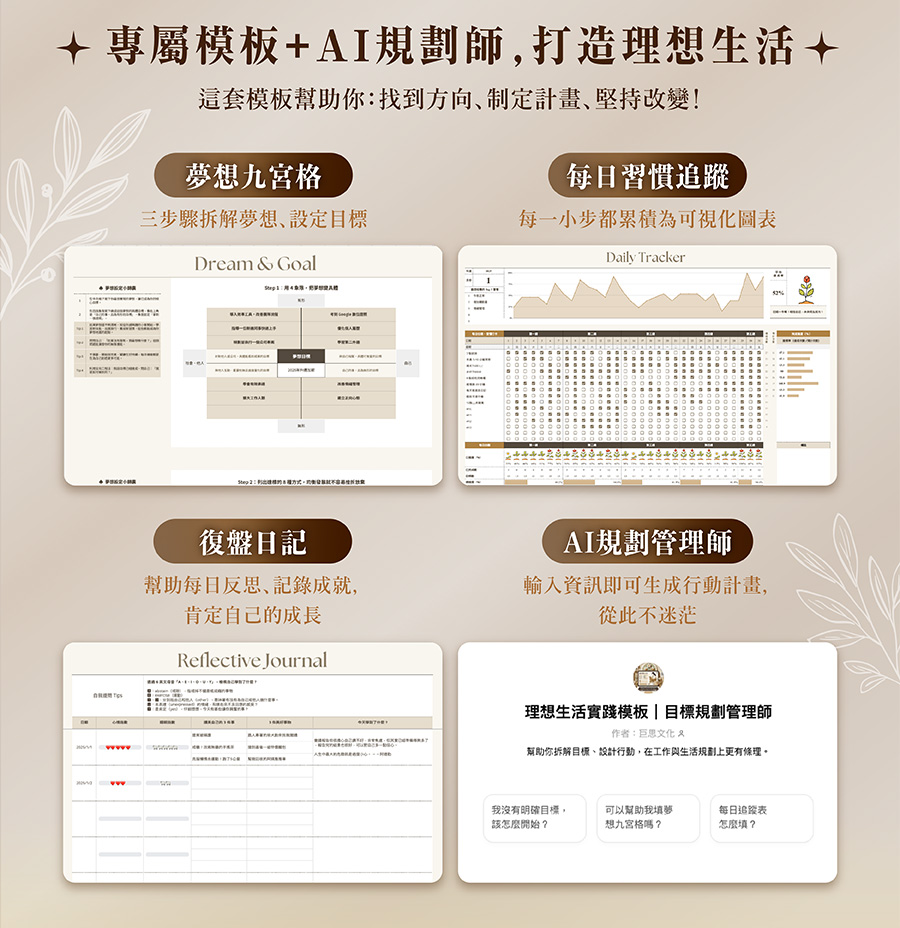

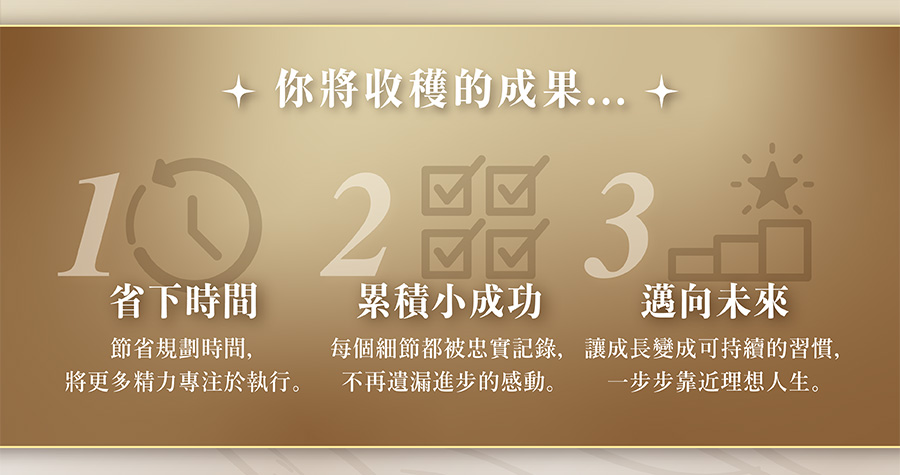

Fwd: 想改變,卻不知道從哪開始?用 Google 互動模板 + AI 規劃師,幫助你每天進步1%,看見真正的改變 ► 馬上學習

From: 數位時代|社群活動 <bnevent@bnext.com.tw>

Date: Tue, Mar 4, 2025 at 13:59

Subject: 想改變,卻不知道從哪開始?用 Google 互動模板 + AI 規劃師,幫助你每天進步1%,看見真正的改變 ► 馬上學習

To: <royfang@m-commerce.com>

2️⃣

Fwd: [電子報長文] (自)媒體的 AI 焦慮指南

From: 曼報 | Manny Li <manny@manny-li.com>

Date: Tue, Mar 4, 2025 at 06:16

Subject: [電子報長文] (自)媒體的 AI 焦慮指南

To: Roy <RoyFang@m-commerce.com>

|

2️⃣

Fwd: ✅ OpenAI 正式推出 GPT-4.5

📣/X0000200/2️⃣/

From: Brief AI 電子報 <ai@mail.briefnewsletter.com>

Date: Sun, Mar 2, 2025 at 6:00 PM

Subject: ✅ OpenAI 正式推出 GPT-4.5

To: royfang@m-commerce.com <royfang@m-commerce.com>

|

2️⃣

2️⃣

Fwd: Private AI on Your Smartphone

From: TAAFT - There's An AI For That <hi@mail.theresanaiforthat.com>

Date: Tue, Feb 25, 2025 at 15:12

Subject: Private AI on Your Smartphone

To: royfang@m-commerce.com <royfang@m-commerce.com>

|

2️⃣

Fwd: Grok 3 Faces Censorship Controversy 🚨

📣/X0000200/2️⃣/

From: Horizon AI <mail@joinhorizon.ai>

Date: Mon, Feb 24, 2025 at 9:03 AM

Subject: Grok 3 Faces Censorship Controversy 🚨

To: royfang@m-commerce.com <royfang@m-commerce.com>

|

2️⃣

Fwd: TSS#144: Psychological effect of Virtual Try-On

📣/X0000200/*️⃣/

From: Swapratim Roy <sr@marvinxr.com>

Date: Sat, Feb 22, 2025 at 5:53 AM

Subject: TSS#144: Psychological effect of Virtual Try-On

To: Roy Fang <royfang@m-commerce.com>

|

|

2️⃣

Fwd: The Next Instagram/Linkedin will be for software/AI, not content

From: Guillermo Flor from Product Market Fit <venturestreet+how-vcs-invest@substack.com>

Date: Thu, Feb 20, 2025 at 09:46

Subject: The Next Instagram/Linkedin will be for software/AI, not content

To: <royfang@m-commerce.com>

The Next Instagram/Linkedin will be for software/AI, not contentIs this the future of Social Media? Let me know what you think

Hey everybody, welcome to the Product Market Fit Newsletter! Follow me on X if you don’t already. Subscribe So, I’ve had a startup idea in my mind for some time, and I wante to know your opinion. It might be the stupidest/craziest thing ever, so please bear with me. For the past decade, social media has been about one thing: content. Social media allow you to share: text, picture, videos. That’s it! And well, it was a big breakthrough. But what happens when content isn't the most valuable thing you can share? I’ve had this idea on my mind for a while, and now seeing Lovable and Cursor, I think it’s about time it happensBuilding software is becoming ridiculously easy. Tools like Lovable and Courser are making it so simple that in two years, shipping an AI-powered tool will feel as easy as creating a PDF. So, I’m thinking… Doesn’t it make sense that the next social media will allow people to also upload the softaware’s they've built, so people can see them and try them on a feed? Imagine a feed where you don’t just consume ideas—you interact with actual tools

The best software—like the best content—goes viral. The most useful, crazy, or well-designed tools will get traction, and this attention could drive traffic to full-fledged products or unlock new business models. Does this make sense?If you’re reading this, I genuinely want your opinion.

I want to pick your brain—reply, comment, DM me. Let’s think this through. Best, Guillermo You're currently a free subscriber to Product Market Fit. For the full experience, upgrade your subscription. © 2025 Guillermo Flor |

2️⃣

Fwd: ICANN duped, .in change, 100-year domains and more

From: Andrew Allemann <editor@domainnamewire.com>

Date: Mon, Feb 17, 2025 at 09:08

Subject: ICANN duped, .in change, 100-year domains and more

To: Roy <RoyFang@m-commerce.com>

|

2️⃣

Fwd: Why personalized advertising is the future of marketing

From: Neil Patel <np@neilpatel.com>

Date: Sat, Feb 15, 2025 at 10:06

Subject: Why personalized advertising is the future of marketing

To: <royfang@m-commerce.com>

|

Personalization can significantly boost engagement, conversions, and ROI. From dynamic product recommendations to hyper-targeted campaigns, consumers expect tailored experiences—and personalized advertising delivers exactly that. Cheers, Neil Patel PS: Ready to get personal? Reach out so we can help you drive results for your business! |

Unsubscribe | Update your profile | 9710 River Trader St, Las Vegas, Nevada 89178

2️⃣

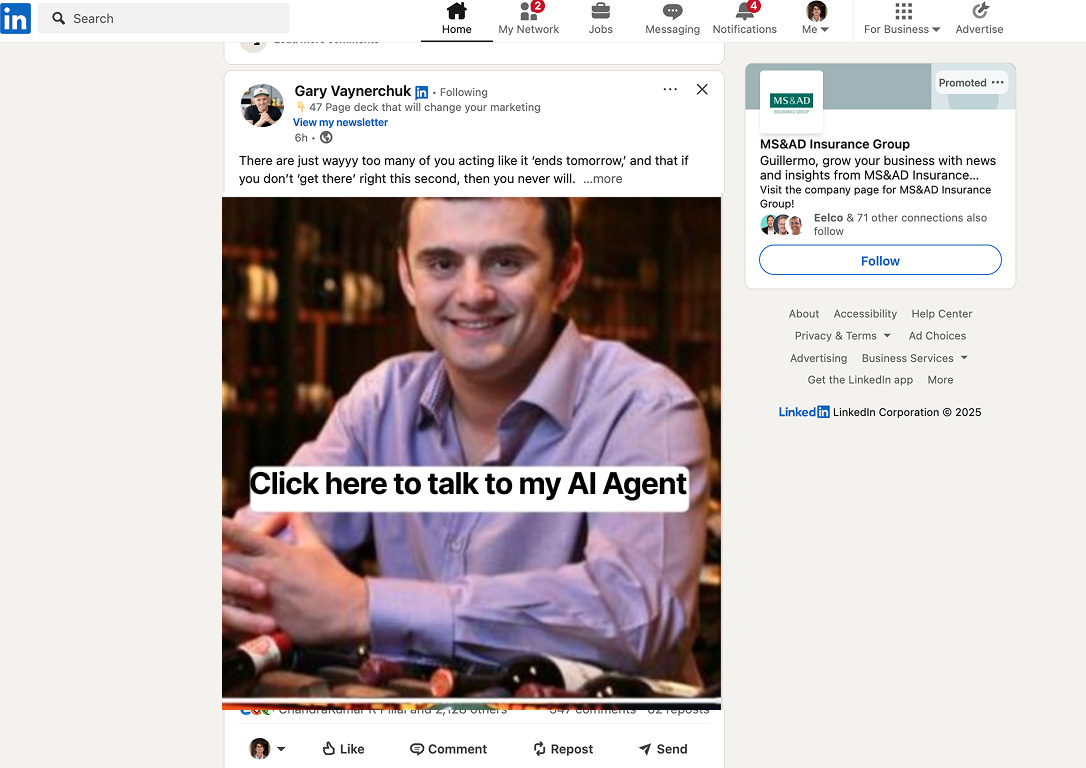

Fwd: Unilever hikes marketing spend by €900m | Review of the Week: Uber Eats | Valentine's Day 2025: ad round-up

|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| This Bulletin has been sent to royfang@m-commerce.com | |

|

© 2025 Haymarket Media Group Bridge House 69 London Road Twickenham TW1 3SP Phone: +44 (20)8267 5000 |

|

| Manage bulletins Unsubscribe Privacy notice | |

|

||

2️⃣

Fwd: Sam Altman teases GPT-5

From: Superhuman – Zain Kahn <superhuman@mail.joinsuperhuman.ai>

Date: Thu, Feb 13, 2025 at 6:05 AM

Subject: Sam Altman teases GPT-5

To: royfang@m-commerce.com <royfang@m-commerce.com>

|

2️⃣

Fwd: Launch.app is on Product Hunt!

From: Store.app <noreply@store.app>

Date: Wed, Feb 12, 2025 at 10:18

Subject: Launch.app is on Product Hunt!

To: <royfang@m-commerce.com>

Once again, thanks for your support, we appreciate having you in our community! 😁

- Morgan, Mathieu, and Tanay from the Store.app/Launch.app team

P.S. If the link above doesn't work: https://www.producthunt.com/posts/launch-app?utm_source=other&utm_medium=email

2️⃣

你就是下個產業創新典範🏆 2025 FCA 創新商務獎徵件中

2️⃣

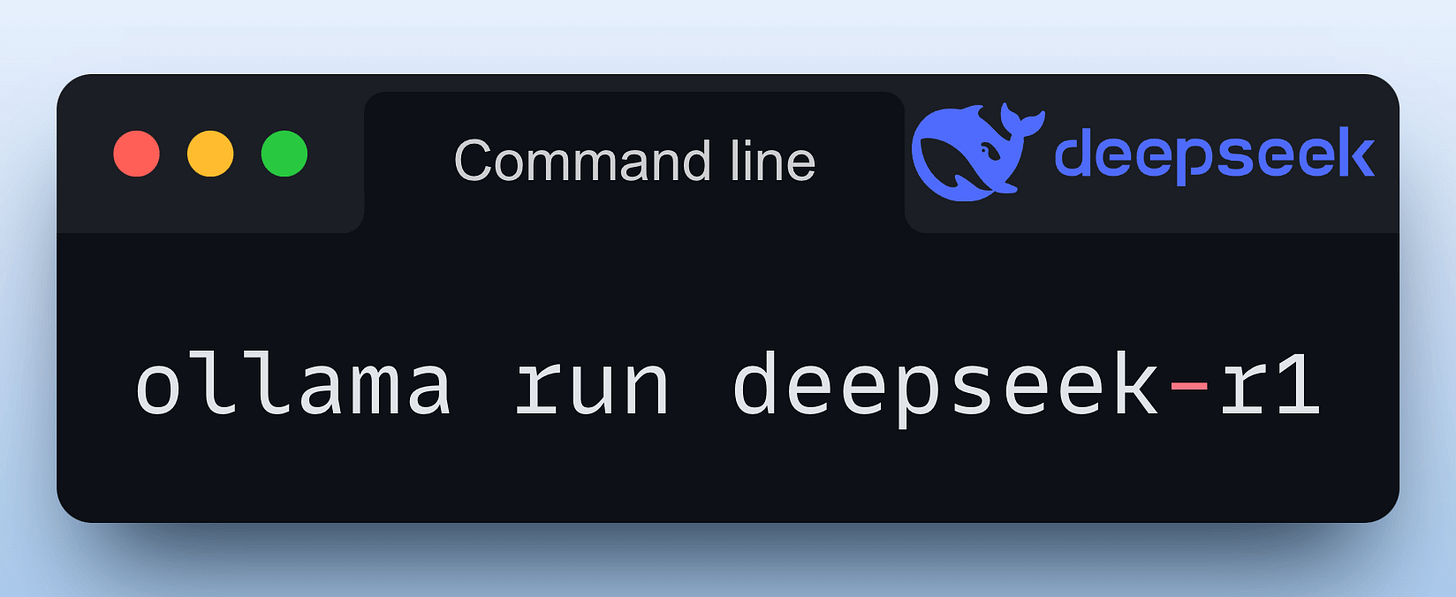

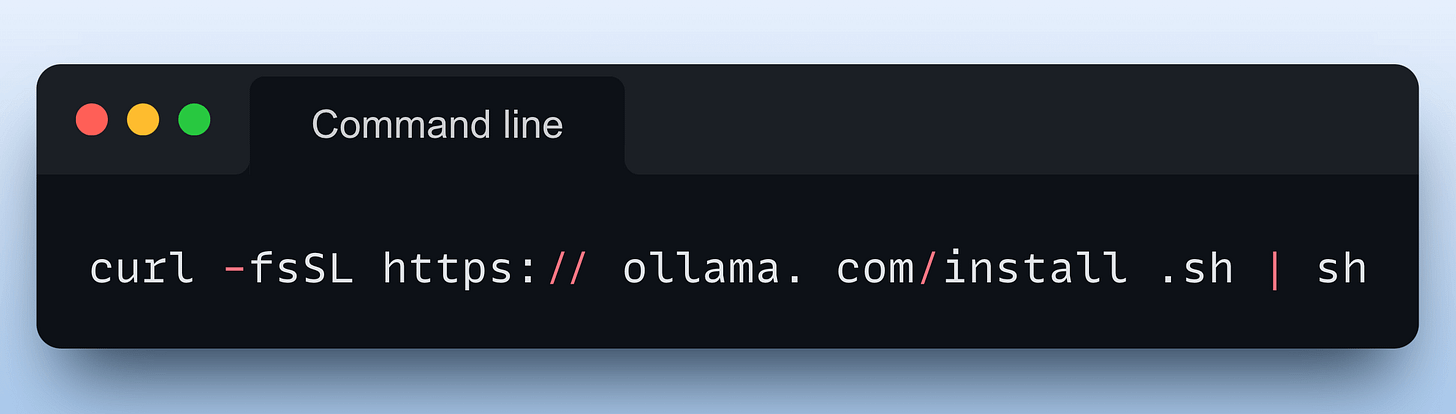

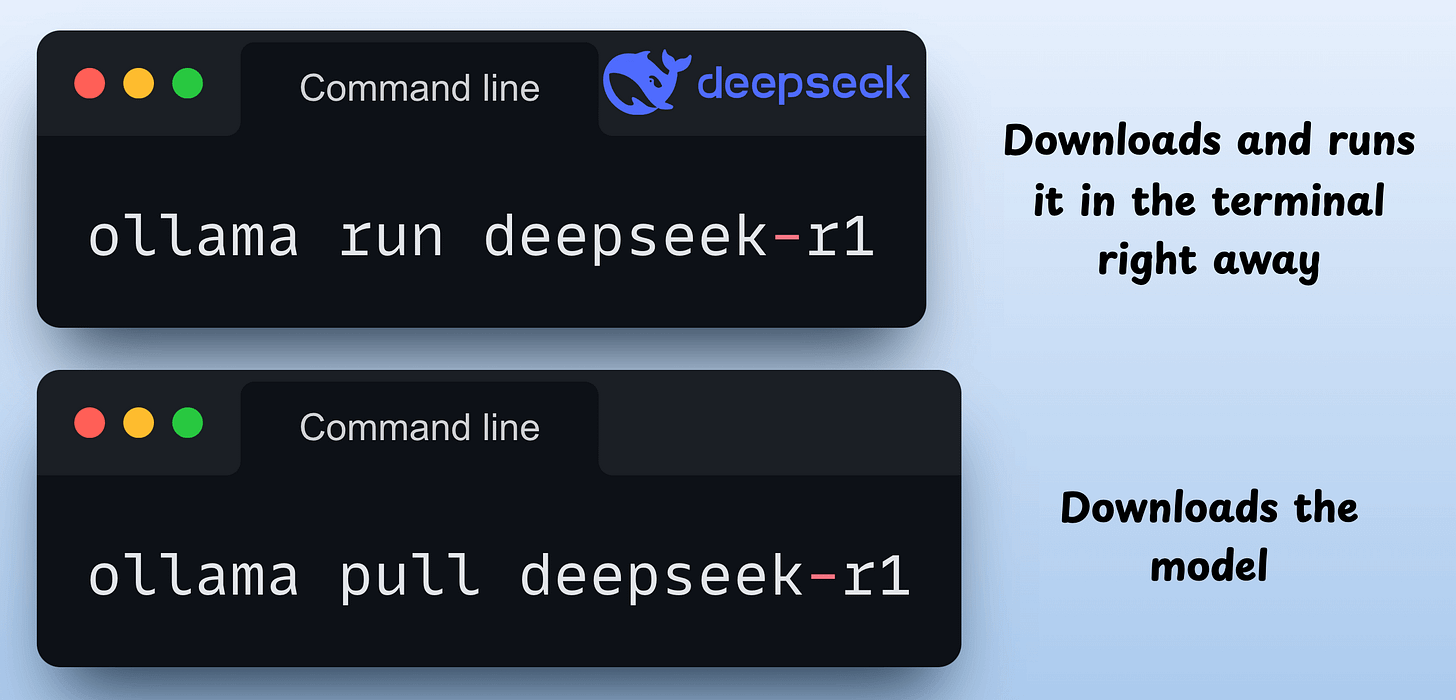

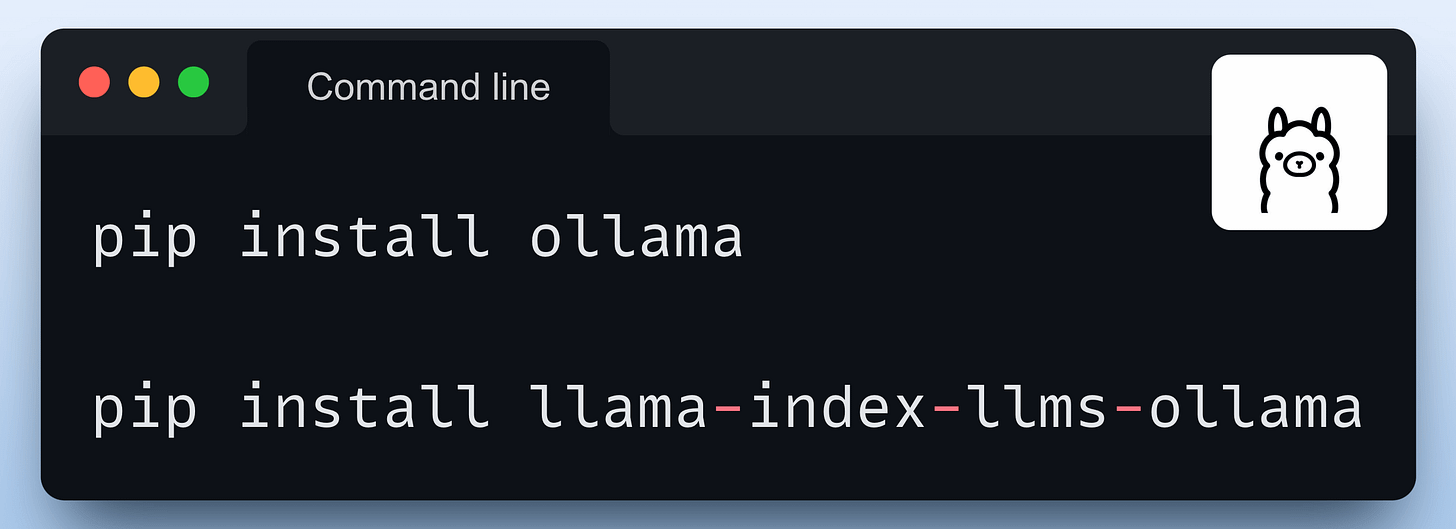

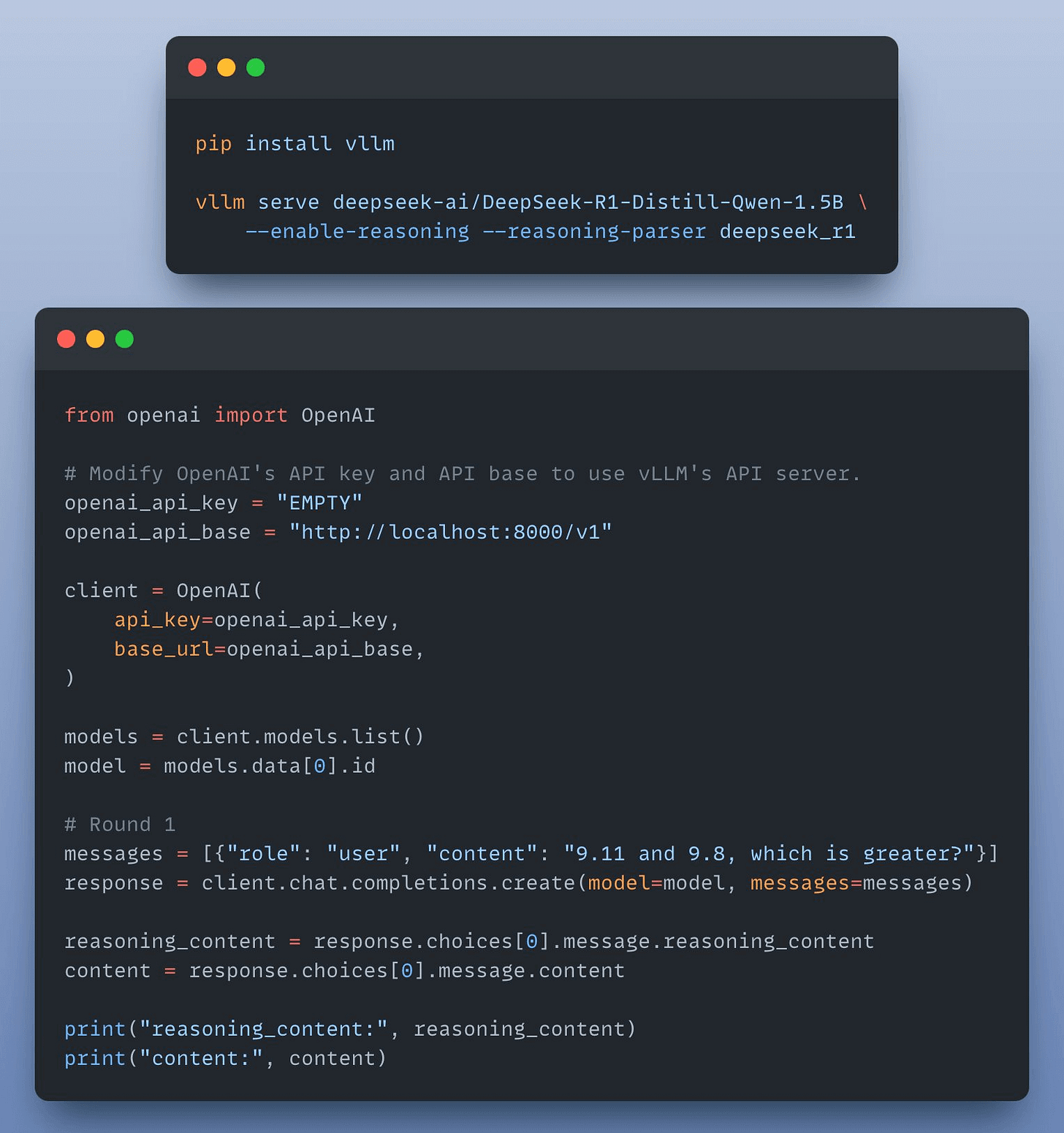

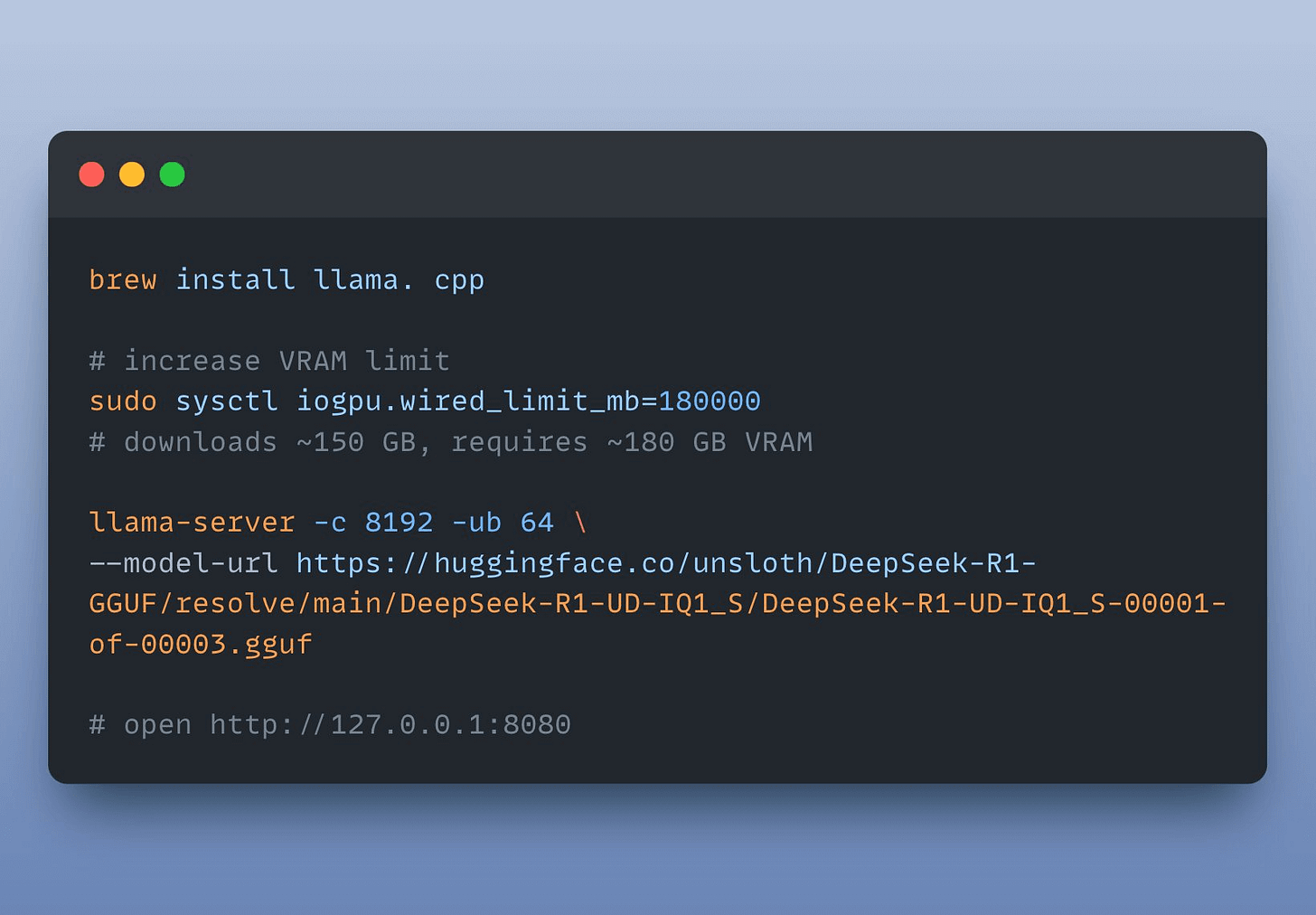

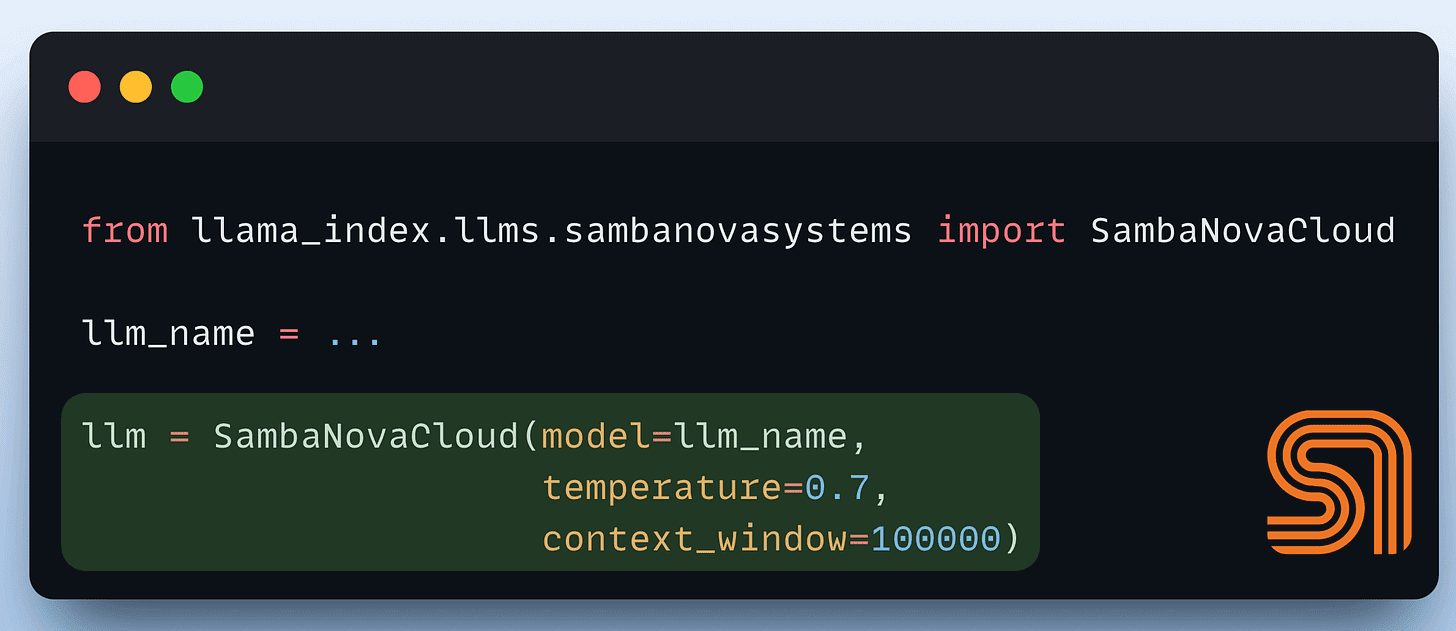

Fwd: 4 Ways to Run LLMs Locally

From: Daily Dose of DS <avi@dailydoseofds.com>

Date: Mon, Feb 10, 2025 at 11:25

Subject: 4 Ways to Run LLMs Locally

To: <royfang@m-commerce.com>

|

2️⃣

Fwd: 【熱烈徵件中🔎】 尋找 5 大關鍵領域的創新應用,攜手高通開啟智慧新賽局🤝🏻 徵件至 2/28 截止,把握加入高通全球新創生態系的絕佳機會,共同競逐 40 萬美元的高額總獎金!

From: 數位時代|社群活動 <bnevent@bnext.com.tw>

Date: Sun, Feb 9, 2025 at 20:01

Subject: 【熱烈徵件中🔎】 尋找 5 大關鍵領域的創新應用,攜手高通開啟智慧新賽局🤝🏻 徵件至 2/28 截止,把握加入高通全球新創生態系的絕佳機會,共同競逐 40 萬美元的高額總獎金!

To: <royfang@m-commerce.com>

2️⃣

Fwd: Revenue per Employee: SaaS vs VC

From: CJ Gustafson from Mostly Metrics <cjgustafson+benchmarks@substack.com>

Date: Sun, Feb 9, 2025 at 12:02

Subject: Revenue per Employee: SaaS vs VC

To: <royfang@m-commerce.com>

What tools does your team use to get the job done?Please take our annual Finance Tech Stack Survey. It takes 3 minutes and is 100% multiple choice and anonymous. I’ll send you a report of the best tools across company sizes. What does the future hold for business? Ask nine experts and you'll get ten answers. It's a bull market. It's a bear market. Rates will rise or fall. Inflation’s up or down. Can someone invent a crystal ball? Until then, over forty-one thousand businesses have future-proofed their business with NetSuite, by Oracle - the number one cloud E.R.P., bringing accounting, financial management, inventory, and HR, into one fluid platform. Whether your company is earning millions or even hundreds of millions, NetSuite helps you respond to immediate challenges and seize your biggest opportunities. Download the CFO’s Guide to AI and Machine Learning for FREE Revenue Per Employee: The GOAT of SaaS MetricsI've long said that Revenue per Employee is the GOAT of SaaS metrics. If 70% of tech company costs walk on two feet, you'd wanna know how much operating leverage you're squeezing out of that spend. And the simplest way? Stack your topline output (revenue) against your means of production (employees). Why This Metric is Elite

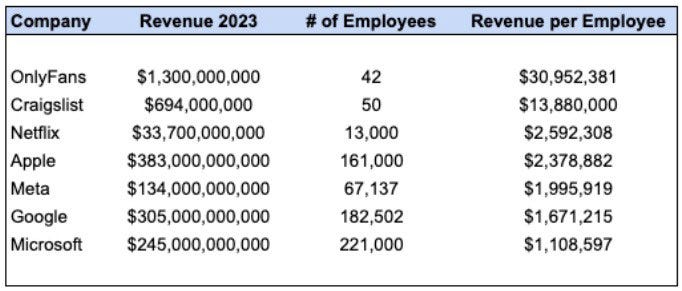

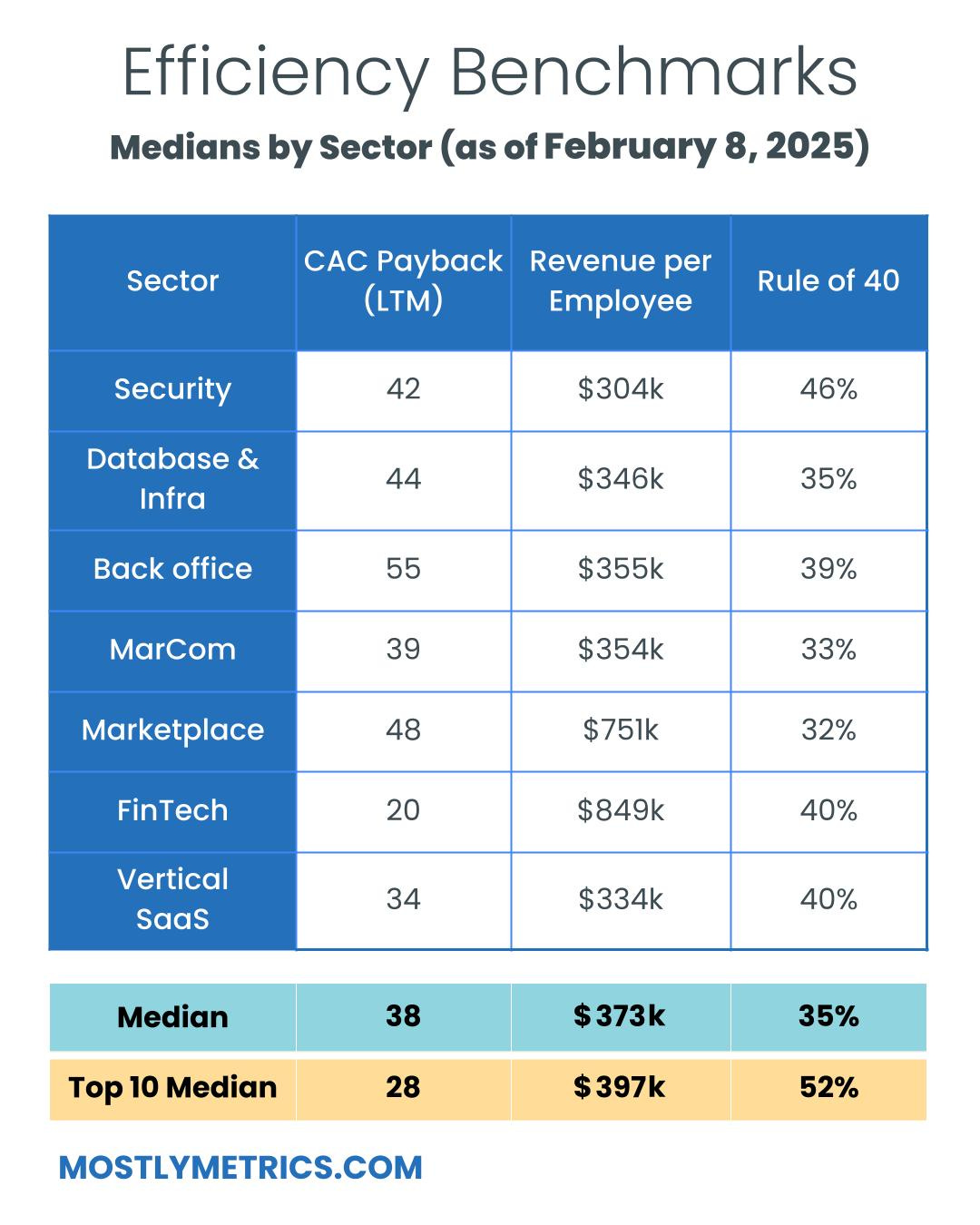

The Debate: Are VCs More Efficient Than the Companies They Fund?I recently got into a debate with a friend: Are venture capital firms actually more efficient businesses than the companies they invest in? (How meta.) So I decided to run the numbers (LOL) and find out. As a baseline for our comparison, the median tech company we track each week is putting out about $400K per employee. There are some outliers, like:

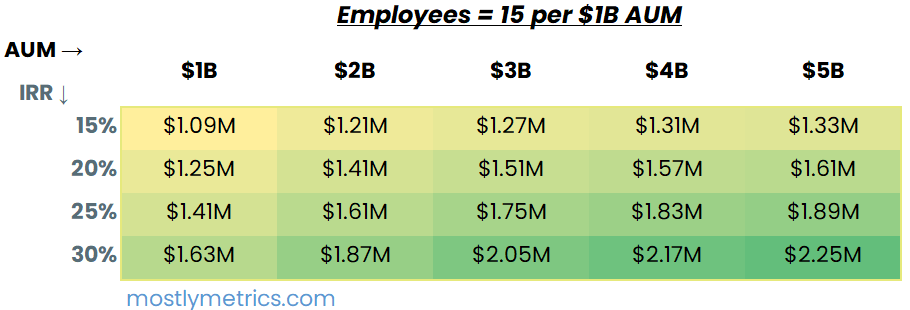

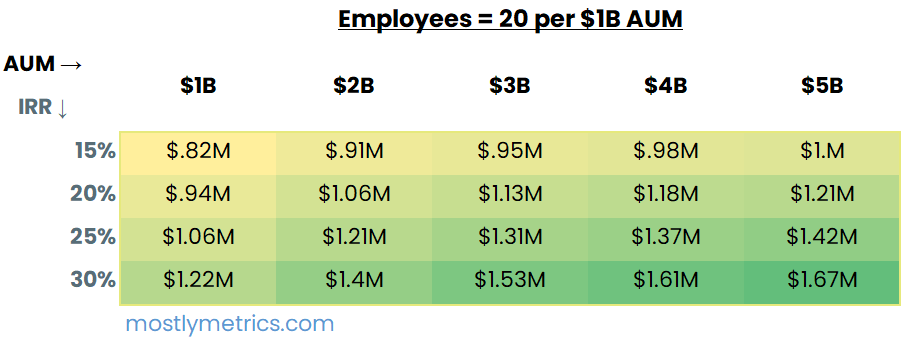

(You’ll notice that fintech’s and marketplaces absolutely RIPPP at scale.) Now to compare… Initially, I considered using publicly traded investment firms like The Carlyle Group, Thoma Bravo, and Warburg Pincus. But they’ve all become multi-strategy shops, making it tough to isolate their pure tech investing arms from their Quantum Credit Dislocation or Collateralized Synthetic Yield Optimization plays. (I made both of those up after watching The Big Short for the 97th time.) So instead, let’s throw some paint against the wall and estimate using VC firms that primarily invest in early- to mid-stage companies—think Benchmark, Index, or Founders Fund-ish. VC Firm Revenue: Management Fees + CarryVenture firms monetize through two main levers:

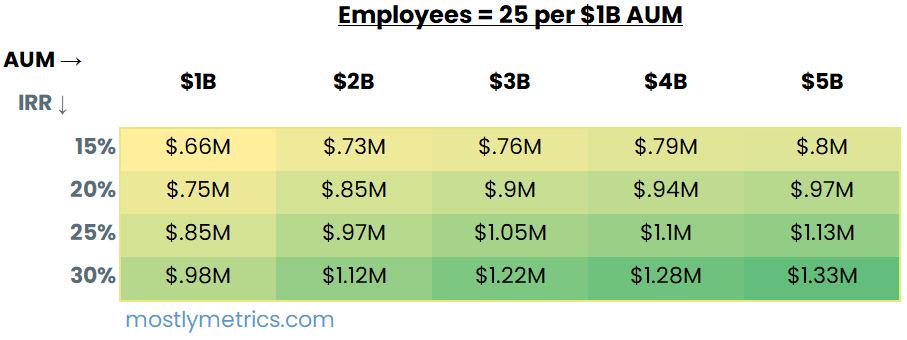

Management fees are recurring—the closest thing to "ARR" for a fund. Carry is performance-based and only unlocks when they exit investments. Here’s an example of the math I went through: Shout out Ms. Galt, my 10th grade math teacher, who always encouraged me to show my work. You the real hero. $3B AUM | 20 Employees per $1B AUM | 25% IRR

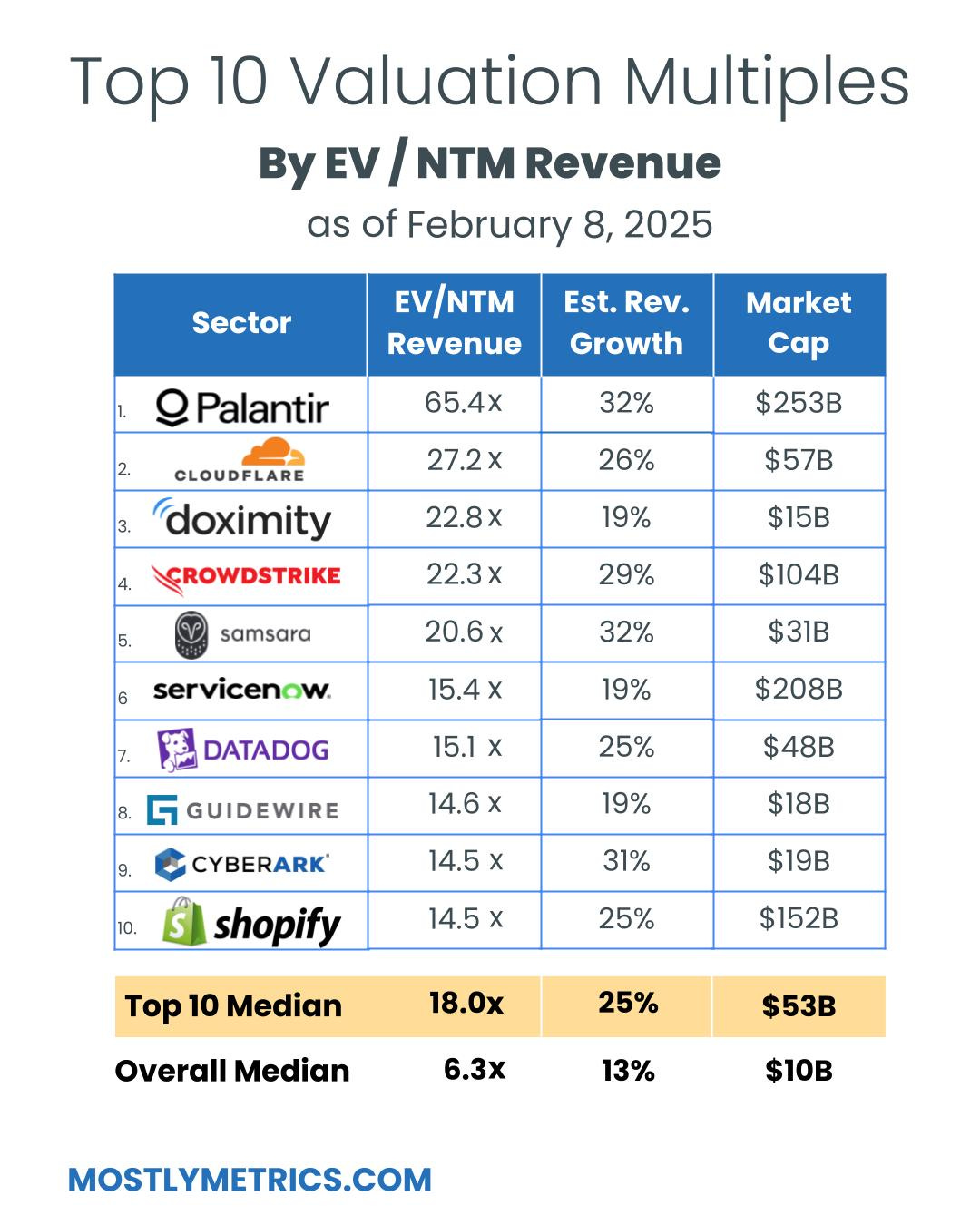

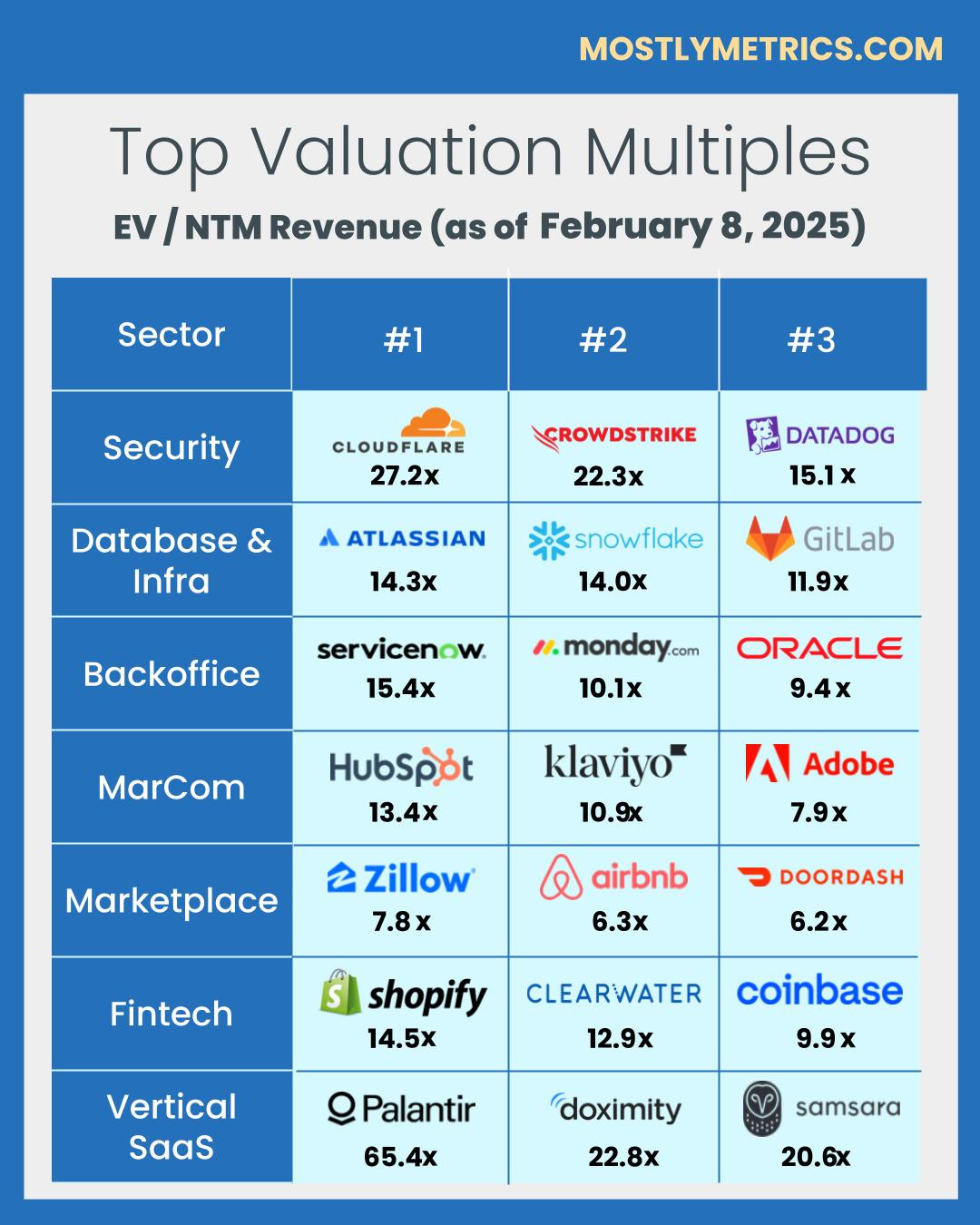

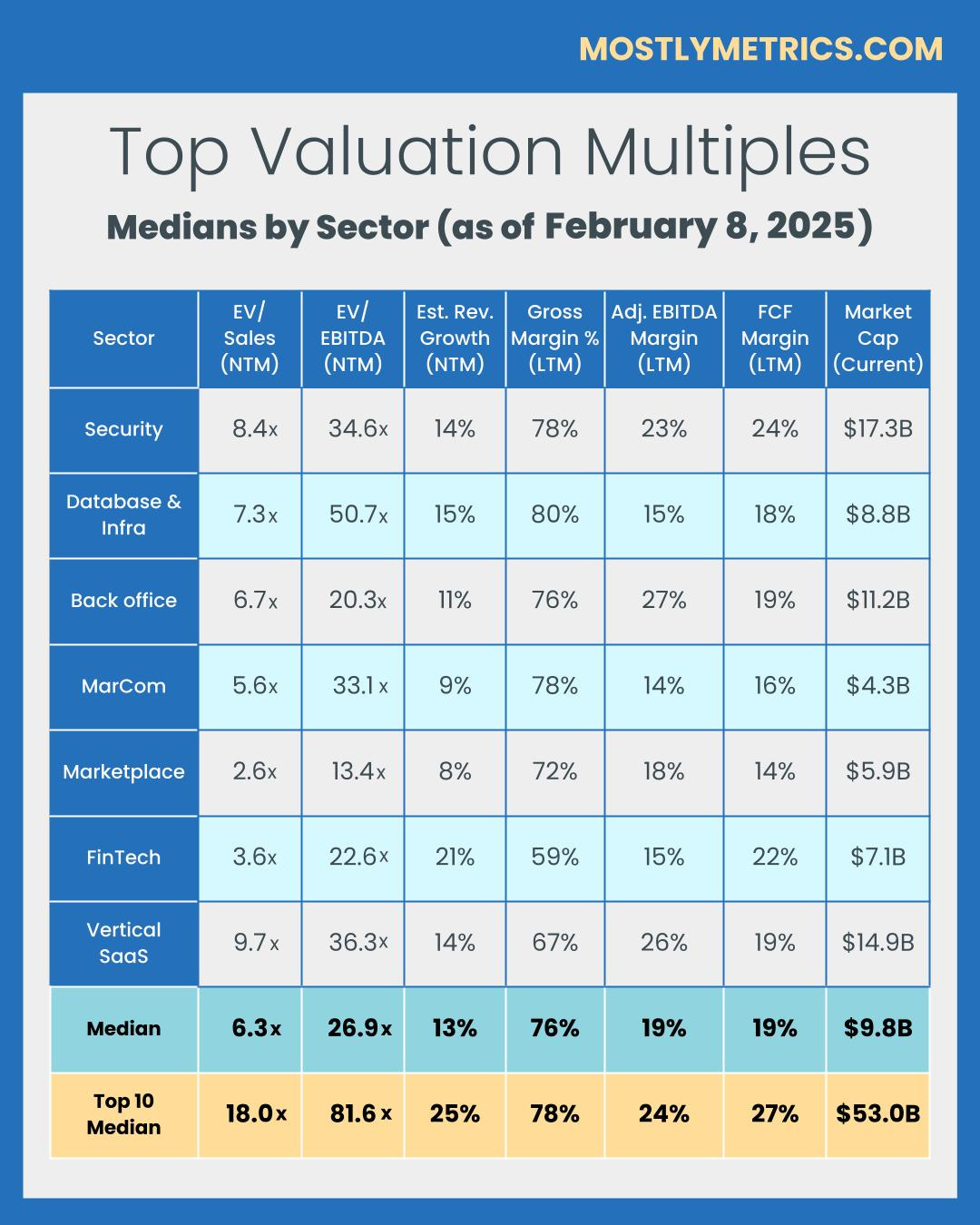

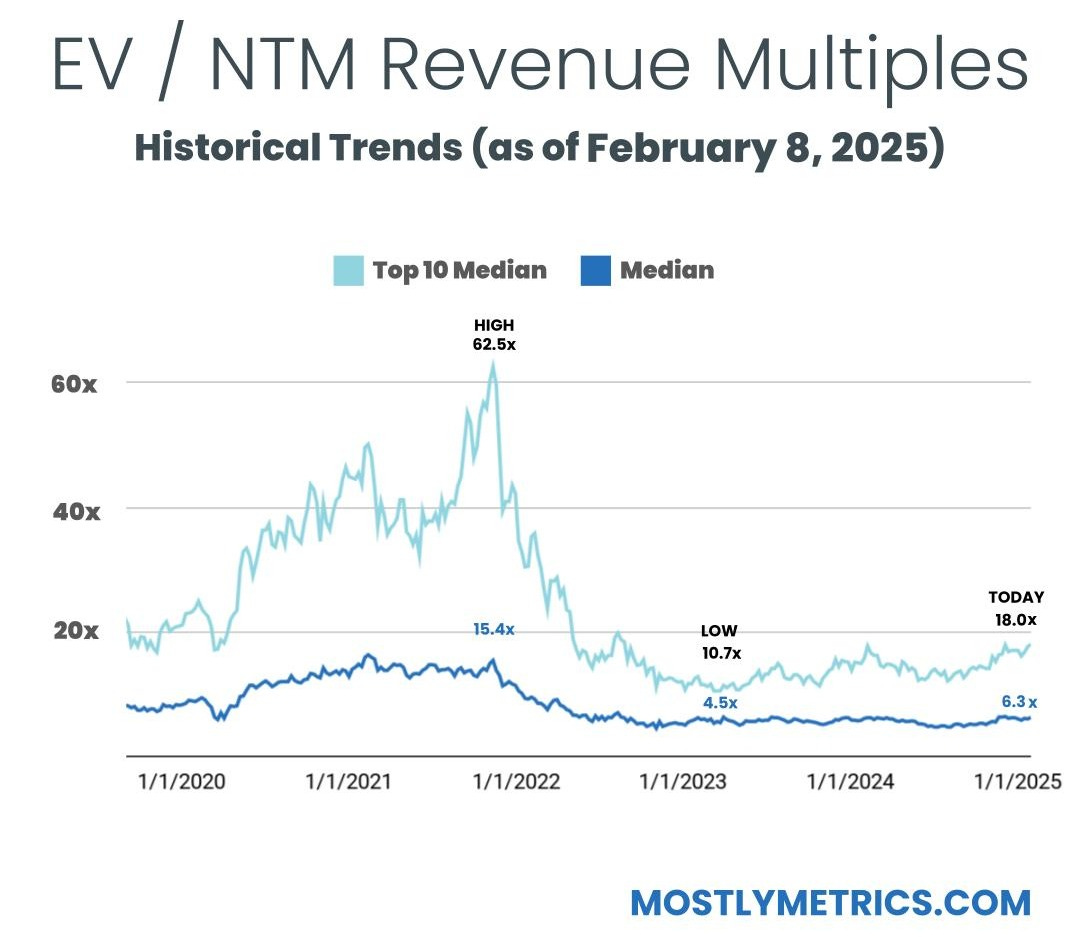

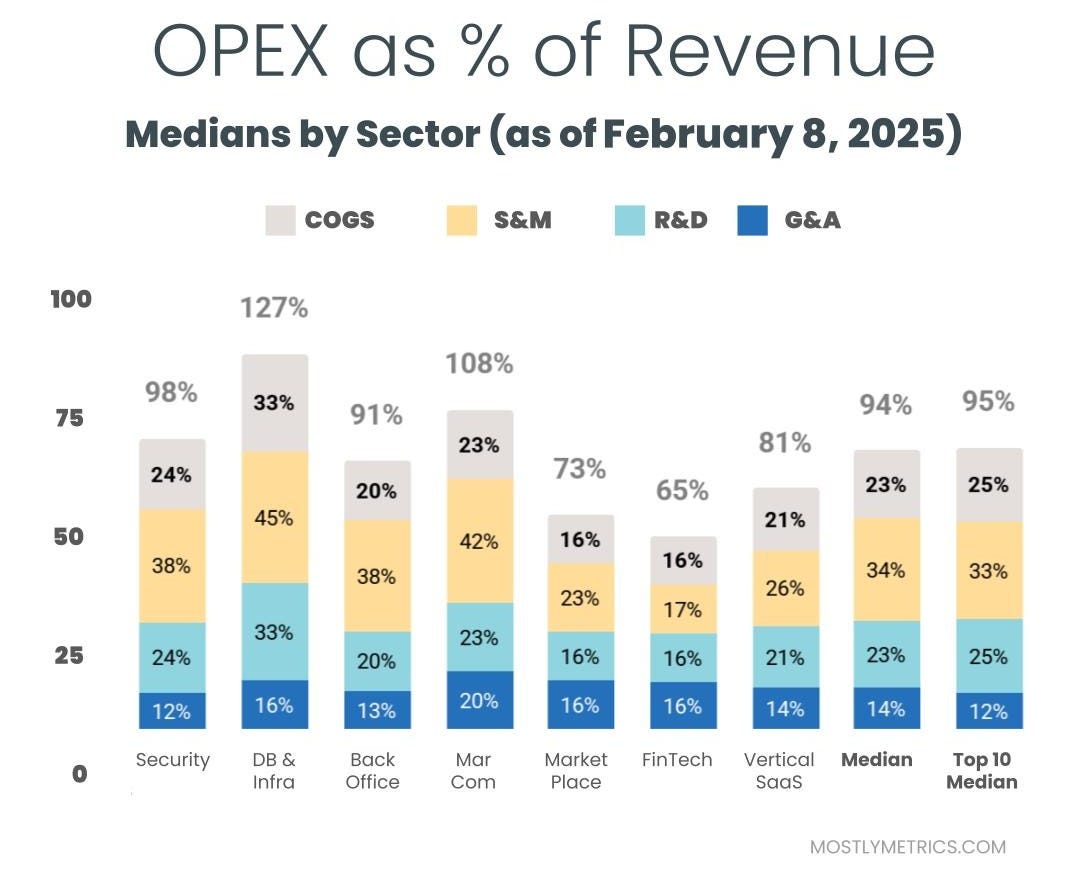

SQUIRREL!Before diving into comparisons, let’s pause on something wild: A fund returning 25% annually (which is really good and not easy to do) actually makes 6x more off management fees than carry, assuming a 10-year life where they’re fully deployed. No wonder so many firms play the capital agglomeration game—scaling AUM to flex the 2% against the fattest number possible. (I digress...) Back to Efficiency—How Does Headcount Affect This?The most sensitive component to this analysis is the relationship between employees and AUM. IRR obviously impacts revenue per employee as well, as better performance generates more carry. I’ve laid out scenarios across various staffing, fund size, and return profiles below. A typical VC firm is about three times more efficient than the average tech company, with revenue per employee landing around ~$1.2M compared to ~$400K in tech. Even when adjusting for a higher headcount, VC firms still maintain a massive efficiency edge. At the top end, elite venture funds—those operating with lean teams (~15 employees per $1B AUM) and delivering 30% IRR—are twice as efficient as even the best-performing tech companies. While fintech and marketplace businesses like Block, Airbnb, and Uber push past $1M per employee, they still can’t match the capital efficiency of a well-run VC shop. And my ultimate takeaway? No one is beating OnlyFans. With an estimated $31M per employee, it’s in a league of its own. Mic (web cam?) drop. TL;DR: Multiples are UP week-over-week. Top 10 Medians:

Mostly metrics is a reader-supported publication. To receive new posts and support my work, consider becoming a free or paid subscriber.

Revenue MultiplesRevenue multiples are a shortcut to compare valuations across the technology landscape, where companies may not yet be profitable. The most standard timeframe for revenue multiple comparison is on a “Next Twelve Months” (NTM Revenue) basis. NTM is a generous cut, as it gives a company “credit” for a full “rolling” future year. It also puts all companies on equal footing, regardless of their fiscal year end and quarterly seasonality. However, not all technology sectors or monetization strategies receive the same “credit” on their forward revenue, which operators should be aware of when they create comp sets for their own companies. That is why I break them out as separate “indexes”. Reasons may include:

From a macro perspective, multiples trend higher in low interest environments, and vice versa. Multiples shown are calculated by taking the Enterprise Value / NTM revenue.

Market Cap fluctuates with share price day to day, while Total Debt and Cash are taken from the most recent quarterly financial statements available. That’s why we share this report each week - to keep up with changes in the stock market, and to update for quarterly earnings reports when they drop. Historically, a 10x NTM Revenue multiple has been viewed as a “premium” valuation reserved for the best of the best companies. Efficiency BenchmarksCompanies that can do more with less tend to earn higher valuations. Three of the most common and consistently publicly available metrics to measure efficiency include:

A few other notes on efficiency metrics:

Operating ExpendituresDecreasing your OPEX relative to revenue demonstrates Operating Leverage, and leaves more dollars to drop to the bottom line, as companies strive to achieve +25% profitability at scale. The most common buckets companies put their operating costs into are:

All of these are taken on a Gaap basis and therefore INCLUDE stock based comp, a non cash expense. Please check out our data partner, Koyfin. It’s dope.Sponsor this newsletter and reach CFOsBuy a sub for the whole team (get a fat group discount)Note: Many of our readers expense this newsletter as a part of their Learning and Development Budgets. Here’s a template if you are trying to sell your boss on it. |

2️⃣

Fwd: Google挑人才最看重這「4種特質」!人資長:英文好、名校畢業不是關鍵|數位早報

From: 數位時代 <bneditor@bnext.com.tw>

Date: Sun, Feb 9, 2025 at 16:01

Subject: Google挑人才最看重這「4種特質」!人資長:英文好、名校畢業不是關鍵|數位早報

To: <royfang@m-commerce.com>

|

2️⃣

Fwd: Will Elon Musk control a nuclear weapon?

From: Flipboard Sunday Reads <editorialstaff@flipboard.com>

Date: Sun, Feb 9, 2025 at 16:55

Subject: Will Elon Musk control a nuclear weapon?

To: <RoyFang@m-commerce.com>

| |

|

|

|

|

|

|

2️⃣

Fwd: SunBrief#15: Deepseek’s Data Breach Exposed

📣/X0000200/2️⃣/

From: Smarter with AI <smarterwithai@mail.beehiiv.com>

Date: Sun, Feb 9, 2025 at 5:03 AM

Subject: SunBrief#15: Deepseek’s Data Breach Exposed

To: royfang@m-commerce.com <royfang@m-commerce.com>

|

2️⃣

Fwd: ChatGPT is coming for Google Search

|

2️⃣

Fwd: 不委屈、不討好,也能建立正向關係✨ 讓賴佩霞陪你好好說話|【紅岩之息】全球首創雙波段紅光⭕️ 一鍵深入細胞修復疲勞|【寶島野球史詩】12 首棒球經典歌曲全收錄⚾

From: WaBay 挖貝 <contact@edm.wabay.tw>

Date: Fri, Feb 7, 2025 at 4:03 AM

Subject: 不委屈、不討好,也能建立正向關係✨ 讓賴佩霞陪你好好說話|【紅岩之息】全球首創雙波段紅光⭕️ 一鍵深入細胞修復疲勞|【寶島野球史詩】12 首棒球經典歌曲全收錄⚾

To: <royfang@m-commerce.com>

|

2️⃣

Fwd: let DeepSeek do your marketing 🤫

From: ali mirza <ai-and-marketing@mail.beehiiv.com>

Date: Thu, Feb 6, 2025 at 13:07

Subject: let DeepSeek do your marketing 🤫

To: royfang@m-commerce.com <royfang@m-commerce.com>

|

*️⃣

Fwd: Here's the guide: No-code tools for founders and owners

From: Stripe <updates@e.stripe.com>

Date: Tue, Jan 21, 2025 at 12:32

Subject: Here's the guide: No-code tools for founders and owners

To: <RoyFang@m-commerce.com>

|

||||||||||

|

|

||||||||||

|

||||||||||

|

|

||||||||||

|

*️⃣

Fwd: 品牌故事如何為網站注入靈魂?✨

From: Cindy架站趣 <cindy@ycindy.tw>

Date: Thu, Jan 16, 2025 at 20:51

Subject: 品牌故事如何為網站注入靈魂?✨

To: <RoyFang@m-commerce.com>

|

每次在做免費諮詢時,我都會問對方:「請問你是如何找到我的?」 大多數的回答是透過網站搜尋、FB廣告或社團,也有透過朋友推薦的。然而,前陣子的一個回答讓我印象深刻: 對方透過網路搜尋找到我的網站,但其實她當時並不打算架設網站,只是單純在查找資料。因為部落格文章符合她的需求,她點進來了。 但真正讓她留下來,卻是我的品牌故事。她說,看了「關於我」頁面後,被我的故事吸引,於是訂閱了電子報,直到最近有需求時才聯繫我。 這個故事讓我更加堅信:品牌故事就是網站的靈魂! 當訪客第一次進入網站,可能只是匆匆一瞥。但如果妳的品牌故事能引起她們的共鳴,就能與她們建立情感連結,甚至讓她們成為妳的長期粉絲。 那麼,如何撰寫足夠吸引人的品牌故事呢?這裡分享幾個撰寫方向,以我的品牌故事為例: ✅ 妳的核心價值是什麼? ✅ 妳為什麼想要打造個人品牌? ✅ 妳能幫助誰? 如果妳有網站但還沒有品牌故事,試著將自己的經歷與初心寫下來,加入到網站中吧! 讓妳的網站不僅是一個工具,而是一個充滿靈魂的橋樑,吸引更多人認識妳、相信妳❤️ 如果妳想讓現在的網站更具吸引力,希望我幫妳看看網站的現況,歡迎加入官方Line,回覆「我想要免費網站健檢」。 若還沒有網站,想在近期想打造獲利吸睛的高質感網站,也可以與我預約諮詢喔! PS 最近想要開設一堂線上研討會,如果妳對以下主題有興趣,歡迎回信告訴我,或是到社團裡參加投票喲! 1.創業女性如何3個月內打造高質感的個人品牌網站 2.創業女性如何3個月內打造高轉換率的個人品牌網站 3.創業女性如何3個月內打造可變現的個人品牌網站 Cindy |

Unsubscribe | Update your profile | 113 Cherry St #92768, Seattle, WA 98104-2205 |

*️⃣

Fwd: Travel Tuesday: Around the World from $85

Imagine yourself wandering through Europe’s iconic cobblestone streets, marveling at timeless landmarks that have stood for centuries. Picture the vibrant energy of Asia, where traditions blend seamlessly with modern wonders. Envision the breathtaking beauty of Africa’s landscapes, teeming with wildlife and rich cultural heritage. Let your senses come alive as you explore the colors, flavors, and history of India.

This is your opportunity to bring these dreams to life.

With round-trip international flights starting at just $85* total, the world has never been more accessible.

Seats are filling quickly, and these unbeatable fares won’t last forever. Don’t miss out on the chance to make 2025 the year you explore, experience and discover new places.

Secure your tickets and start planning the journey of a lifetime.

Contact us to secure your spot and let's start planning your adventure of a lifetime. Our travel agents are available 24/7.

Get in touch with us, and let’s begin planning your journey.

(855) 651-7959

toll-free, 24/7

Lost Baggage Protection

24/7 Customer Support

Group and Family Discounts

Easy Installment Payment Options

You are receiving this email because you signed up to receive our latest news

and special offers on asaptickets.com.

*All the above listed fares are round-trip economy class airfares per adult person in USD, and include all taxes, fees and applicable surcharges. Best fares are available from major US cities (PHL, WAS, BOS, HOU, NYC, LAX, SFO, CHI, SEA, HNL, MIA & others). Fares are based on weekday travel (Monday through Thursday) and are valid for departures: Feb 1- Mar 31 and/or Sep 1- Oct 31, 2025. Minimum stay – 5 days. Maximum stay – 3 months. Advance Purchase - up to 14 days. The advertised fares are for individual travel and cannot be used for group travel. The fares are subject to seat availability in the corresponding booking inventory. Seats are limited and may not be available on all flights and dates. Some blackout dates may apply. The fares are non-refundable, non-exchangeable, and non-transferable. The fares and their governing rules are subject to change without prior notice. Other restrictions may apply. Less restrictive fares are available. Fares shown were last found on 01/14/2025. Other departure cities in the U.S. and destinations in Latin America, U.S., Canada, Europe, Asia, Africa, Middle East & North Africa, India & Subcontinent and Oceania as well as other airline deals are available at a different price. Airline-imposed baggage fees are not included and may apply. Sale ends: Jan 19, 2025.

100 N West Street, Suite 1200, Wilmington, DE 19801

1️⃣

Fwd: Your new workout shoes are here

From: Nike <nike@official.nike.com>

Date: Sun, Jan 12, 2025 at 08:14

Subject: Your new workout shoes are here

To: <royfang@m-commerce.com>

|

3️⃣

Fwd: 🍎 Anthropic要復刻蘋果「iFund生態系」

From: 創業小聚日日報 <meeteditor@bnext.com.tw>

Date: Wed, Dec 25, 2024 at 08:31

Subject: 🍎 Anthropic要復刻蘋果「iFund生態系」

To: <royfang@m-commerce.com>

|

3️⃣

Fwd: 不滿收購中心:將消費者負面情緒轉化為企業創新力量

「不滿買取センター」

(---------- Forwarded message ---------

From: Joel Fukuzawa <subscriptions@medium.com>

Date: Sun, Dec 22, 2024 at 8:10 PM

Subject: 不滿收購中心:將消費者負面情緒轉化為企業創新力量

To: <royfang@m-commerce.com>

Joel Fukuzawa ∙ 4 min read ∙ View on Medium不滿收購中心:將消費者負面情緒轉化為企業創新力量 消費者不滿成商機的創新平台在日本,由Insight Tech株式會社推出的「不滿買取センター」(不滿收購中心)自2015年問世以來,短短數年間便吸引了超過73萬名會員,累積高達4500萬筆的不滿紀錄。這個平台以收購人們日常生活中的不滿為主旨,透過將這些瑣碎但真實的煩惱轉化為企業改善產品和服務的數據,實現消費者與企業之間的雙贏模式。 「不滿收購中心」的概念或許乍聽之下頗為新奇,然而其背後的核心理念簡單直接:讓消費者將日常生活中微不足道卻頻繁出現的不便具象化,進一步為企業提供真實的市場需求。 平台運作模式與AI技術的結合該平台的使用方式極為簡便。用戶只需下載應用程式或透過網站進行免費註冊,即可開始提交生活中的各種不滿。例如,冰箱冷凍庫在夜晚打開時沒有燈光,導致需要額外開燈,或是鍵盤容易積灰且無法輕易清潔等問題,皆可成為投稿內容。Insight T … Continue reading This is a member-only story and can only be read on Medium. Sent to royfang@m-commerce.com by Joel Fukuzawa on Medium Unsubscribe from this newsletter or unsubscribe from all newsletters from Medium Manage your email settings Medium, 548 Market St, PMB 42061, San Francisco, CA 94104 Careers·Help Center·Privacy Policy·Terms of service |

3️⃣

Fwd: ☕ End of an Eras

From: Morning Brew <crew@morningbrew.com>

Date: Mon, Dec 9, 2024 at 18:25

Subject: ☕ End of an Eras

To: <royfang@m-commerce.com>

|

3️⃣

Fwd: Omnicom & IPG could redraw adland’s power map | The Lists: Top media buyers | Croud CEO & COO depart

From: Campaign Media <bulletins@em.campaignlive.co.uk>

Date: Mon, Dec 9, 2024 at 18:26

Subject: Omnicom & IPG could redraw adland’s power map | The Lists: Top media buyers | Croud CEO & COO depart

To: <royfang@m-commerce.com>

|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

3️⃣

📣/X0000200/

The best postponed posting for Telegram

Telepost helps channel administrators cut down on routine and focus on production of quality content. It has deferred posts, a visual editor, collaboration, and more. And most importantly, it is completely free!

3️⃣

Fwd: "Crushed my mini"

|

Verify your email

Please enter your email address to receive a 4-digit code.

3️⃣

Fwd: 【港式飲茶首選】義享時尚廣場6F「蒸鮮腸粉」 週二~週五刷一銀義享聯名卡單筆滿3,000元送300元館內刷卡金!

From: 第一銀行信用卡 <fcb@news.firstbank.tw>

Date: Sun, Dec 1, 2024 at 8:11 AM

Subject: 【港式飲茶首選】義享時尚廣場6F「蒸鮮腸粉」 週二~週五刷一銀義享聯名卡單筆滿3,000元送300元館內刷卡金!

To: <RoyFang@m-commerce.com>

提醒您:此為系統發送,請勿直接回覆此信!

|

|||||||||||||||||||||||||||||||||||||||||||||

|

|||||||||||||||||||||||||||||||||||||||||||||

|

|||||||||||||||||||||||||||||||||||||||||||||

© All Rights Reserved. First Commercial Bank.

3️⃣

Fwd: Run LLMs Locally with Ollama

From: Daily Dose of DS <avi@dailydoseofds.com>

Date: Mon, Nov 11, 2024 at 15:47

Subject: Run LLMs Locally with Ollama

To: <royfang@m-commerce.com>

|

3️⃣

Fwd: Super-personalisation tips for marketers - see you tomorrow!

From: Campaign <IndustryInsights@em.campaignlive.co.uk>

Date: Mon, Nov 11, 2024 at 07:15

Subject: Super-personalisation tips for marketers - see you tomorrow!

To: <royfang@m-commerce.com>

| Hi Roy, Final reminder for tomorrow's webinar, 'It’s all about you: what super-personalisation means for marketers in 2025', happening at 10am GMT. Register here and feel free to send in any questions you’d like us to cover. Whether you’re wondering how to make the most of your first-party data, how AI is shaping dynamic creative optimisation, or how all of this impacts your ROAS — we’re here to help you make sense of it. If you can’t make it, don't worry. Simply sign up here and we’ll send you the on-demand session once it's available. Looking forward to seeing you there. All the best, Campaign This email has been sent to royfang@m-commerce.com If you would like to amend your email communications from Campaign UK, please click here. Campaign UK is a publication of Haymarket Media Group. Registered office: Bridge House, 69 London Road Twickenham, Greater London TW1 3SP. Privacy Notice. |

3️⃣

Fwd: 'SNL' declares a certain kind of 'support' for Trump

From: Flipboard Sunday Reads <editorialstaff@flipboard.com>

Date: Sun, Nov 10, 2024 at 18:14

Subject: 'SNL' declares a certain kind of 'support' for Trump

To: <RoyFang@m-commerce.com>

| |

|

|

|

|

|

|

3️⃣

Fwd: News For You: Introducing the all-new TikTok Academy.

From: TikTok For Business <newsletter@discover.tiktok.com>

Date: Thu, Nov 7, 2024 at 07:43

Subject: News For You: Introducing the all-new TikTok Academy.

To: <royfang@m-commerce.com>

|

3️⃣

Fwd: 🤯 it's giveaway time!

Date: Wed, Oct 23, 2024 at 11:07 AM

Subject: 🤯 it's giveaway time!

To: <royfang@m-commerce.com>

|

3️⃣

Fwd: Last Chance to Upgrade: 20% Off Unlimited Plan

From: ClickUp Team <team@mail.clickup.com>

Date: Sat, Oct 12, 2024 at 3:02 AM

Subject: Last Chance to Upgrade: 20% Off Unlimited Plan

To: <royfang@m-commerce.com>

|

3️⃣

Fwd: Revamp Your Content Instantly with AI Rewrite 🔄

From: Tanmay @predis.ai <hello@predis.ai>

Date: Sat, Oct 12, 2024 at 4:05 AM

Subject: Revamp Your Content Instantly with AI Rewrite 🔄

To: <royfang@m-commerce.com>

|

Too Boring to hear from us? Unsubscribe here Unsubscribe View in browser

3️⃣

Fwd: 科技商品特輯 🚀 不可錯過

From: Costco 好市多 <costcotaiwan@marketing.costco.com.tw>

Date: Fri, Oct 11, 2024 at 11:20 AM

Subject: 科技商品特輯 🚀 不可錯過

To: <royfang@m-commerce.com>

|

3️⃣

Fwd: Thankyou for subscription

📣/X0000200/

From: sujitdas

Date: Fri, Oct 4, 2024 at 4:04 PM

Subject: Thankyou for subscription

To: <royfang@m-commerce.com>

|

3️⃣

Fwd: 🔬 Google 也將投入推理 AI 的研發 ?!

From: Brief AI 電子報 <ai@mail.briefnewsletter.com>

Date: Fri, Oct 4, 2024 at 10:00 AM

Subject: 🔬 Google 也將投入推理 AI 的研發 ?!

To: royfang@m-commerce.com <royfang@m-commerce.com>

|

3️⃣

Fwd: Your Weekly Must-See Savings 🤑 + 📲 App Ex clusive Offer

From: Grocery Outlet <store@mail.groceryoutlet.com>

Date: Wed, Oct 2, 2024 at 8:20 PM

Subject: Your Weekly Must-See Savings 🤑 + 📲 App Exclusive Offer

To: <royfang@m-commerce.com>

|

3️⃣

=?UTF-8?B?RndkOiDkvaDlnKggdm9jdXMg6Zec5rOo55qE5pyA5paw5YWn5a655YuV5oWL77ya44CQ?= =?UTF-8?B?5LuK5aSp5piv6ZuZ5Y2B5ZyL5oW25pel44CR5pys5pyf5Li76aGM562W5bGV77yM5q2h6L+O5Yqg5YWl?= 「自由創作」!

📣/X0000200/

From: 方格子 | vocus <service@vocus.cc>

Date: Thu, Oct 10, 2024 at 10:26 AM

Subject: 你在 vocus 關注的最新內容動態:【今天是雙十國慶日】本期主題策展,歡迎加入「自由創作」!

To: <royfang@m-commerce.com>

3️⃣

Fwd: WOW! deals for September 22, 2024

|

3️⃣

Fwd: dropping in to say thanks! 😎

📣/X0000200/

From: Jesse

Date: Sun, Oct 6, 2024 at 10:40 AM

Subject: dropping in to say thanks! 😎

To: <royfang@m-commerce.com>

|

3️⃣

Fwd: Simple and powerful GPU Droplets available now

From: DigitalOcean <team@info.digitalocean.com>

Date: Wed, Oct 2, 2024 at 3:40 AM

Subject: Simple and powerful GPU Droplets available now

To: <RoyFang@m-commerce.com>

|

|

|

|

|

|

|

This email was sent to RoyFang@m-commerce.com. You can update your email subscription preferences at any time.

3️⃣

Pin

3️⃣

Fwd: 💸 Google won $1.7B in a Legal Battle

From: Smarter with AI <smarterwithai@mail.beehiiv.com>

Date: Sun, Sep 22, 2024 at 11:02 PM

Subject: 💸 Google won $1.7B in a Legal Battle

To: royfang@m-commerce.com <royfang@m-commerce.com>

|

3️⃣

Fwd: Kuochun, this 50K bonus mile offer can help take you places

From: MileagePlus Partner <MileagePlus_Partner@enews.united.com>

Date: Mon, Sep 23, 2024 at 6:49 AM

Subject: Kuochun, this 50K bonus mile offer can help take you places

To: <royfang@m-commerce.com>

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||

|

|

|

|

3️⃣

Fwd: Mastering the Art of Communication: How AI and Kaeka Are Revolutionizing Speech Training | Joel Fukuzawa

From: Medium Daily Digest <noreply@medium.com>

Date: Tue, Oct 1, 2024 at 7:40 AM

Subject: Mastering the Art of Communication: How AI and Kaeka Are Revolutionizing Speech Training | Joel Fukuzawa

To: <royfang@m-commerce.com>

Today's highlights See more of what you like and less of what you don’t.Read from anywhere.Unsubscribe from this type of email·Switch to the Weekly Digest·Careers·Help Center·Privacy Policy·Terms of service |

3️⃣

3️⃣

Fwd: Beer lovers descend on Oktoberfest

From: Flipboard Photo Desk + AP <editorialstaff@flipboard.com>

Date: Sat, Sep 28, 2024 at 12:41 PM

Subject: Beer lovers descend on Oktoberfest

To: <RoyFang@m-commerce.com>

| |

|

|

|

|

|

|

3️⃣

Post by udio on X

| ||||||||||||||||||||||||

3️⃣

Fwd: [The Omniverse City] Roy, you unlocked the Omniverse City Achievement Omnifolk License Activation Award

From: The Omniverse City <charlene@sellsmart-nothard.com>

Date: Thu, Sep 26, 2024 at 8:54 AM

Subject: [The Omniverse City] Roy, you unlocked the Omniverse City Achievement Omnifolk License Activation Award

To: <RoyFang@m-commerce.com>

|

||||||

3️⃣

=?UTF-8?B?RndkOiDoh6rli5XljJblt6XnqIvluKvjgIHplovnmbzkurrlk6HjgIFJVCDmsbrnrZY=?= =?UTF-8?B?6ICFLi4u5L2c5qWt55Kw5aKD5Y2h5Y2h55qE77yfUmVkSGF06Kej5pa55427562W77yMTGludXjnpZ4=?= =?UTF-8?B?5Yqp5pS78J+RieaDs+S6huino+abtOWkmui2hemAsuWMlkxpbnV477yf8J+TjOeyvua6luWwjeaOpQ==?= 🚀

From: 數位時代|社群活動 <bnevent@bnext.com.tw>

Date: Thu, Sep 26, 2024 at 5:30 PM

Subject: 自動化工程師、開發人員、IT 決策者...作業環境卡卡的?RedHat解方獻策,Linux神助攻👉想了解更多超進化Linux?📌精準對接🚀

To: <royfang@m-commerce.com>

3️⃣

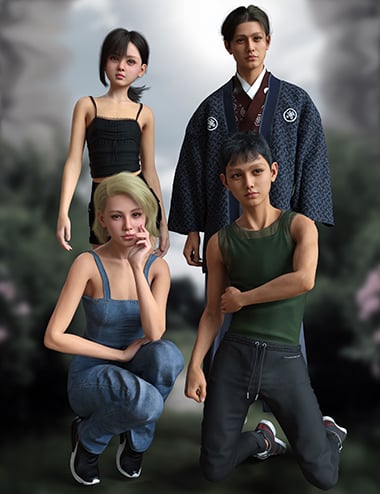

Fwd: Oso’s Robot Servant and a New Bundle Join the 2024 Published Artist Sale

From: Daz 3D <sales@daz3d.com>

Date: Thu, Sep 26, 2024 at 3:09 PM

Subject: Oso’s Robot Servant and a New Bundle Join the 2024 Published Artist Sale

To: <royfang@m-commerce.com>

|

3️⃣

Fwd: 👋 welcome to Beacons!

From: Jesse from Beacons <jesse@hello.beacons.ai>

Date: Thu, Sep 26, 2024 at 2:04 PM

Subject: 👋 welcome to Beacons!

To: <RoyFang@m-commerce.com>

|

3️⃣

=?UTF-8?B?RndkOiDwn5uNIFBhcnRpcG9zdCDoqr/mn6XlsYDvvJrlgJ/li6LooYzpirfnnJ/nmoQ=?= 有用?

📣/X0000200/

From: Partipost <business.tw@partipost.com>

Date: Wed, Sep 25, 2024 at 3:29 PM

Subject: 🛍 Partipost 調查局:借勢行銷真的有用?

To: <royfang@m-commerce.com>

|

|

3️⃣

3️⃣

Fwd: 台湾经贸网电子报 2024-09-25

From: Taiwantrade Newsletter <subscribeletter@taiwantrade.com>

Date: Wed, Sep 25, 2024 at 5:47 AM

Subject: 台湾经贸网电子报 2024-09-25

To: <one@m-commerce.com>

|

| |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

3️⃣

Fwd: Notify Me helps you book hard-to-get tables

From: OpenTable <OpenTable@mgs.opentable.com>

Date: Wed, Sep 25, 2024 at 5:26 AM

Subject: Notify Me helps you book hard-to-get tables

To: <royfang@m-commerce.com>

|

3️⃣

Fwd: What if Google/Amazon Builds It? - Annoying Questions From VC & How You Should Think. | VC Jobs

From: VC's Newsletter From Venture Crew <theventurecrew@substack.com>

Date: Tue, Sep 24, 2024 at 10:46 PM

Subject: What if Google/Amazon Builds It? - Annoying Questions From VC & How You Should Think. | VC Jobs

To: <royfang@m-commerce.com>

Jeff Bezos' Heuristic for Hiring & Template to build VC Fund deck to raise Millions From LPs

👋Hey Sahil here! Welcome to this bi-weekly venture curator newsletter. Each week, I tackle questions about building products, startups, growth, and venture capital! In today’s newsletter, we dive into -

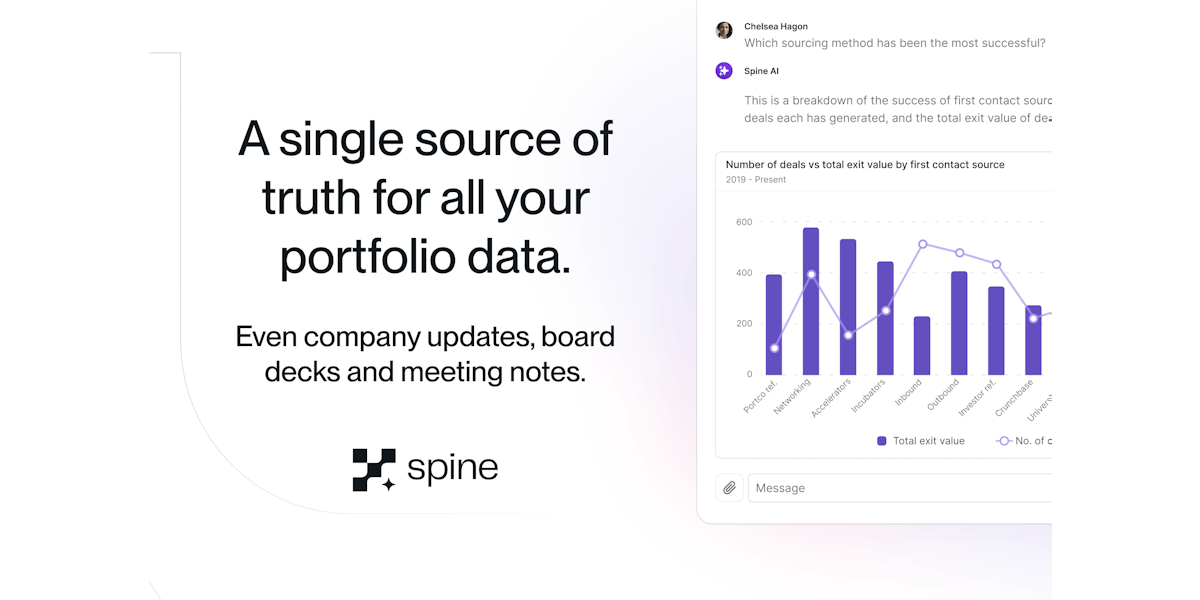

A MESSAGE FROM OUR PARTNER: SPINE AIPortfolio monitoring simplified with reliable AICustom reports that integrate structured data—such as performance metrics—with the context for informed analysis. Automatically surface insights from board decks, meeting notes, and company updates. Transparent referencing ensures reliability. Streamline collaboration for quarterly reporting and valuation analysis, with a consolidated view. → Get comprehensive insights with Spine AI. PARTNERSHIP WITH US

TODAY’S DEEP DIVEWhat if Google/Amazon Builds It? - Annoying Questions From VC & How You Should Think.If you are fundraising or looking to fundraise for your startup, you will see such types of annoying questions from VC :). Not only this, you will find some other things like - I don’t think this can be a venture scale business, We’d be interested when we see a bit more traction, Come back when you have a lead etc… and most founders don’t know how to think on this questions and proceed with it. So in this post, I will try to answer how you can think about above mentioned questions:

You will find a lot of VCs asking this question where Google substitutes with Amazon or Facebook or any other big company. It’s a valid question - this shows your startup edge and how will you win. Here are a couple of answers that may help:

Remember, being small and quick can be your superpower. Use it to outmanoeuvre the giants!

Previously I shared my thought process on how investors think about this particular question, let me know to share more info here Not every business needs venture capital (VC) money. It's like rocket fuel - great if you want to go to the moon but overkill for a quick trip to the store. VCs are looking for companies that can grow incredibly fast and become huge. They want to turn their money into a fortune, and fast. We're talking about businesses that can make $100 million a year in just five years. That's a wild ride, and it's not for everyone. But here's the funny thing: it's really hard to predict which ideas will explode like that. VCs often think they know, but they're wrong all the time. They might ignore a business selling stuff online, thinking it can't grow big enough. But what if it's the next big thing, like Stitch Fix? So, if you're thinking about chasing VC money, ask yourself: Do I really want to build a massive company? Can I handle hiring tons of people and working like crazy? If that sounds exciting, great! Think about how you'll grow your business super fast. How will you double or triple your sales each year? But if that sounds like too much, don't worry. There are other ways to get money for your business. You could talk to individual investors, try crowdfunding, or look into loans based on your revenue. These options are becoming more popular and might be a better fit for your dreams. The most important thing is to be honest with yourself about what kind of business you want to build. There's no shame in staying small or growing slowly if that's what makes you happy. Just make sure you're chasing the right kind of money for your goals.

When a VC tells you they want to see "more traction," it's like they're saying, "I'm not sure about your business, but maybe if you grow more, I'll change my mind." The problem is, most VCs can't really tell you exactly how much growth would convince them. If you suddenly made $100 million, sure, they'd all jump on board. But what if you grow to $100,000 a month in a year? Well... it depends. VCs like to keep their options open, so they'll always want to "check in later" unless you're clearly terrible or a scammer. It's frustrating, right? But here's how to handle it: Don't waste time trying to convince these fence-sitters. Put them in your "not interested" pile. Keep sending them updates, sure, but focus on finding investors who believe in you right now. You're better off meeting tons of investors and quickly figuring out who's actually excited about your idea. Remember, it's like dating. You don't want to spend months trying to convince someone to like you. You want to find someone who's into you from the start. So get out there, talk to lots of investors, and find the ones who get that spark in their eyes when you explain your business. Those are the folks you want on your team. Don't get hung up on the maybes. Keep moving, keep pitching, and the right investors will show up. It's a numbers game, so play it smart and don't let the "show me more traction" crowd slow you down.

When a VC says, "I'm in once you have a lead," they're basically saying, "I don't want to take the risk, but I don't want to miss out either." It's like they're waiting for someone else to give your idea a thumbs up before they jump in. But here's the thing - "lead" can mean different things to different VCs. Some want to see most of your money raised. Others just want to know the deal terms. And some are looking for a big investor to take charge and join your board. So, what do you do? First, get clear on what they mean by "lead." Don't be shy - ask them straight up. If they just want to see most of the money raised, you've got options. You could bring together a bunch of smaller investors without a traditional lead. It's called a party round, and it's pretty common these days. If they're just after the terms, you can set those yourself. Create your own deal on a simple agreement like a SAFE or convertible note. But if they want a big-shot lead investor who'll take a board seat and run the show, that's a whole different ballgame. The key is to not get hung up on these "maybe" investors. Keep moving, keep hustling. Build your round in whatever way works for you. Remember, there's more than one way to skin a cat - or in this case, raise some cash. Don't let the "we need a lead" crowd slow you down. If your idea's good and you keep pushing, you'll find the right investors who believe in you from the start. That's who you want on your team anyway. That’s it. What are the annoying things that you feel VC ask/say to you? Feel free to share in a comment. VENTURE CURATOR HUBAccess Curated Resources, Support Our Newsletter

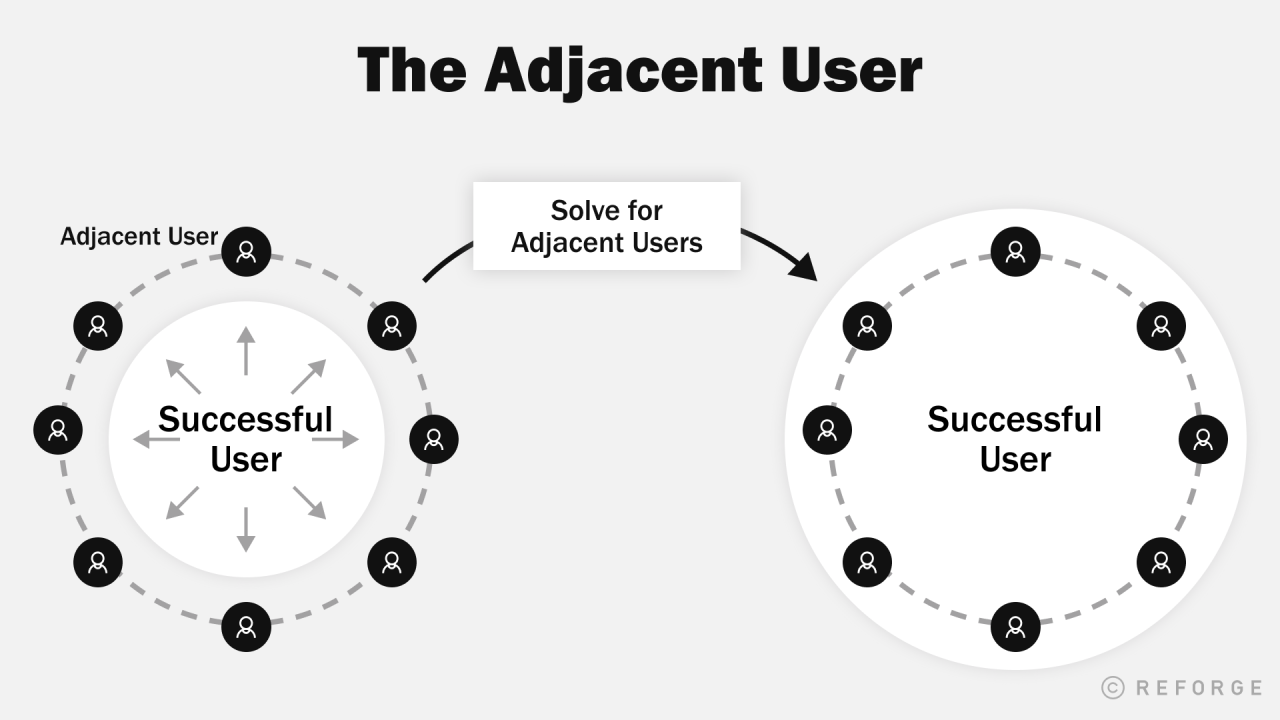

QUICK DIVES1. Your Product's Untapped Growth Opportunity - The Adjacent User Theory By Bangaly Kaba (Former VP Growth @ Instacart, Instagram)The Adjacent User is someone who is interested in your product but faces challenges in fully using it. It’s a methodology for driving growth by focusing on the users who are aware of a product and have tried using it but are not able to successfully become engaged users. These users are on the periphery of a product's current user base and represent untapped potential for growth. Many founders miss this thing, which leads to not capturing full market share… Why Focus on Adjacent Users? Solving for the Adjacent User is critical for a few key reasons:

Identifying Adjacent Users Adjacent Users are those who are circling around the primary thresholds a user must cross to become an engaged, core user. At each threshold, there are users who have an equal or greater chance of not crossing over and drifting away For example, on Instagram, the key thresholds are:

At each stage, there are users who struggle to progress, and solving their problems enables the product to capture more of that audience and grow Challenges in Focusing on Adjacent Users There are a few factors that often lead teams away from focusing on Adjacent Users:

How to Focus on Adjacent Users To start focusing on Adjacent Users:

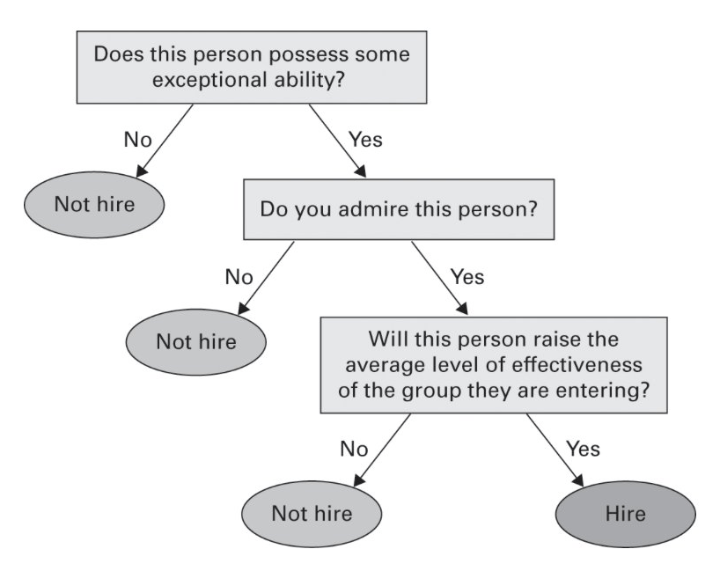

By focusing on Adjacent Users, startups can unlock the true potential of their current product-market fit and drive sustainable growth over time. I would highly recommend checking this article by Andrew Chen. 2. Jeff Bezos' Heuristic for HiringJeff Bezos says he hires people only if they pass 3 separate bars:

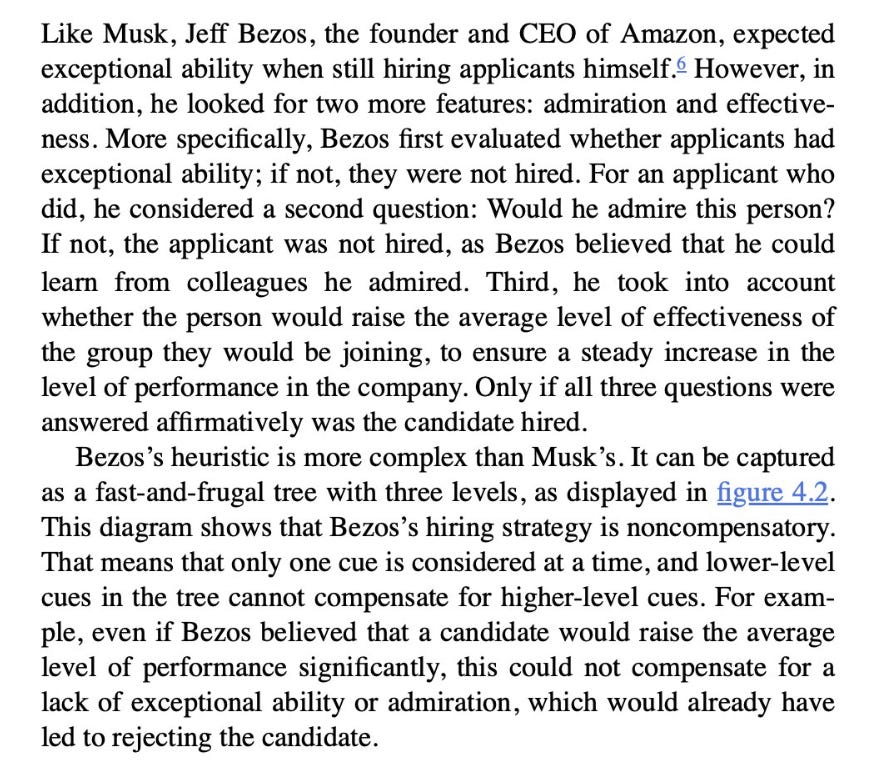

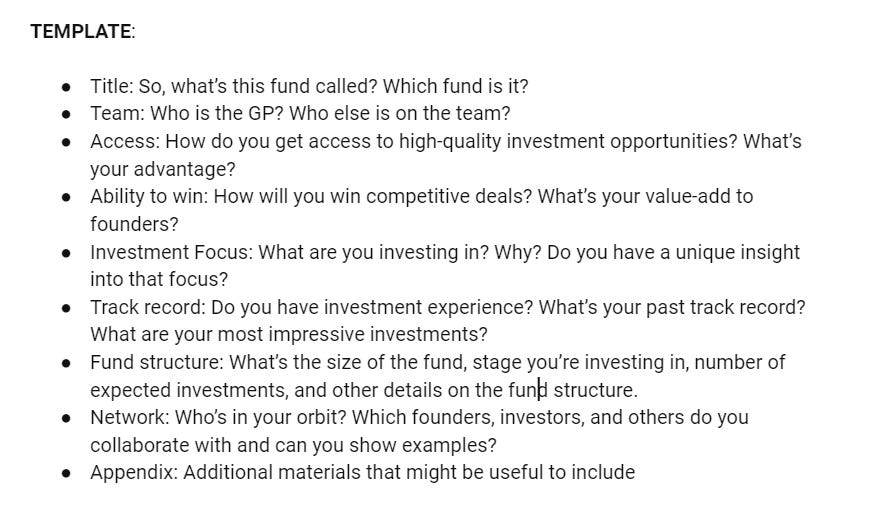

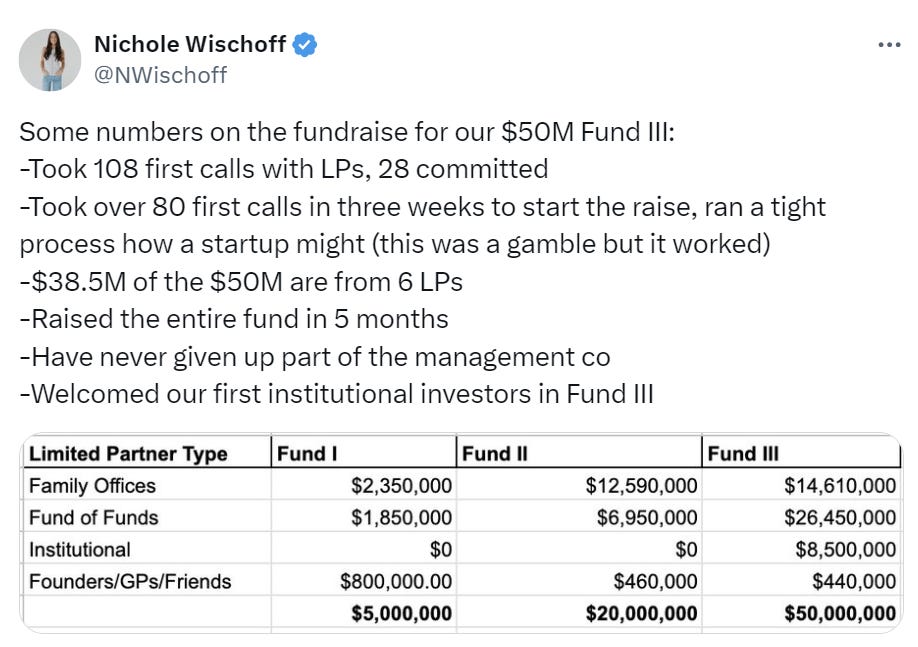

You can get answers to all three of these questions in a single, 30-minute interview if you ask the right questions. I would highly recommend reading - Smart Management by Jochen Reb to learn more about it. 3. How do you build a VC fund deck to raise millions from LPs?Previously, I shared VC fund decks that raised $500 million from LPs. I received many queries about what the format should look like and what emerging fund managers should consider before building a VC fund deck. So, I'm sharing a few points that might be useful to emerging VC fund managers:

After considering these points, you can use the following template to create a VC Fund deck: Also, if you are a solo GP, I would highly recommend checking the thread by Nichole Wischoff (Founder & GP of Wischoff Ventures) on what it takes to raise a VC fund round. Even check out the comments and replies on this thread. Join 35000+ Founders, Investors and Startup Enthusiasts Getting Tactics To Build, Learn and Implement About Startups and Venture Capital. THIS WEEK’S NEWS RECAPMajor News In VC, Startup Funding & Tech

→ Get the most important startup funding, venture capital & tech news. Join 25,000+ early adopters staying ahead of the curve, for free. Subscribed to Venture Daily Digest Newsletter. TWEET OF THIS WEEKBest Tweet I Saw This Week“The truth is that no business plan survives a collision with a real customer. So the trick is to take your idea and set it on a collision course with reality as quickly as possible.” How Can I Help You?

TODAY’S JOB OPPORTUNITIESVenture Capital Jobs & Internships

|

3️⃣

=?UTF-8?B?RndkOiDwn6qEIOS9oOeahOmdiOaEn+S+hua6kOW3sumAgemBlO+8geacrOmAsSB2b2N1cw==?= 熱門創作趨勢

From: 方格子 | vocus <service@vocus.cc>

Date: Tue, Sep 24, 2024 at 8:32 AM

Subject: 🪄 你的靈感來源已送達!本週 vocus 熱門創作趨勢

To: <royfang@m-commerce.com>

|

3️⃣

=?UTF-8?B?RndkOiDwn42977iPIOWcqOmAo+mOlumkkOW7s+iqleeUn++8mk5WSURJQeaIkOWKn+S5iw==?= 路

From: 創業小聚日日報 <meeteditor@bnext.com.tw>

Date: Mon, Sep 23, 2024 at 8:31 AM

Subject: 🍽️ 在連鎖餐廳誕生:NVIDIA成功之路

To: <royfang@m-commerce.com>

|

3️⃣

Fwd: Starlink Easter Eggs / Microsoft Buys Nuclear Power Plant / Anker Recalls Thousands of Portable Batteries

From: PCMag What's New Now <WhatsNewNow@enews.pcmag.com>

Date: Mon, Sep 23, 2024 at 12:02 AM

Subject: Starlink Easter Eggs / Microsoft Buys Nuclear Power Plant / Anker Recalls Thousands of Portable Batteries

To: <royfang@m-commerce.com>

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

3️⃣

Fwd: Starlink Easter Eggs / Microsoft Buys Nuclear Power Plant / Anker Recalls Thousands of Portable Batteries

From: PCMag What's New Now <WhatsNewNow@enews.pcmag.com>

Date: Mon, Sep 23, 2024 at 12:02 AM

Subject: Starlink Easter Eggs / Microsoft Buys Nuclear Power Plant / Anker Recalls Thousands of Portable Batteries

To: <royfang@m-commerce.com>

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

3️⃣

Fwd: Starlink Easter Eggs / Microsoft Buys Nuclear Power Plant / Anker Recalls Thousands of Portable Batteries

From: PCMag What's New Now <WhatsNewNow@enews.pcmag.com>

Date: Mon, Sep 23, 2024 at 12:02 AM

Subject: Starlink Easter Eggs / Microsoft Buys Nuclear Power Plant / Anker Recalls Thousands of Portable Batteries

To: <royfang@m-commerce.com>

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

3️⃣

Fwd: These restaurants are heating up

|

3️⃣

Fwd: WOW! deals for September 22, 2024

|

3️⃣

Fwd: These restaurants are heating up

|

3️⃣

=?UTF-8?B?RndkOiDps6XosrTml48x5bm054Gr6YCf6JC95Zyw5Y+w54Gj77yM5LuW55qE6bue6aCt?= =?UTF-8?B?5pyA6Zec6Y2177yB6aSQ6aOy5ZOB54mM5Y+q5Y2gMyXnh5/mlLbvvIzlpKfmiJDngrrkvZXopoHlkIg=?= 作?|數位早報

From: 數位時代 <bneditor@bnext.com.tw>

Date: Mon, Sep 23, 2024 at 8:02 AM

Subject: 鳥貴族1年火速落地台灣,他的點頭最關鍵!餐飲品牌只占3%營收,大成為何要合作?|數位早報

To: <royfang@m-commerce.com>

|

3️⃣

=?UTF-8?B?RndkOiDps6XosrTml48x5bm054Gr6YCf6JC95Zyw5Y+w54Gj77yM5LuW55qE6bue6aCt?= =?UTF-8?B?5pyA6Zec6Y2177yB6aSQ6aOy5ZOB54mM5Y+q5Y2gMyXnh5/mlLbvvIzlpKfmiJDngrrkvZXopoHlkIg=?= 作?|數位早報

From: 數位時代 <bneditor@bnext.com.tw>

Date: Mon, Sep 23, 2024 at 8:02 AM

Subject: 鳥貴族1年火速落地台灣,他的點頭最關鍵!餐飲品牌只占3%營收,大成為何要合作?|數位早報

To: <royfang@m-commerce.com>

|

3️⃣

Fwd: Why You Might Want to Revisit Your Max Heart Rate | Emily Brown in Runner's Life

From: Medium Daily Digest <noreply@medium.com>

Date: Mon, Sep 23, 2024 at 7:40 AM

Subject: Why You Might Want to Revisit Your Max Heart Rate | Emily Brown in Runner's Life

To: <royfang@m-commerce.com>

Today's highlights See more of what you like and less of what you don’t.Read from anywhere.Unsubscribe from this type of email·Switch to the Weekly Digest·Careers·Help Center·Privacy Policy·Terms of service |

3️⃣

1️⃣

Rules for Purchasing and Selling Brand Domains and Handles

(2024.12.30)

- Purchasing a Property:

You can buy a Brand Domain or Brand Handle ("Property") for a flat fee of US$6.00.

- Setting a Selling Price:

Set a selling price known as NYP (Name Your Price).

- Bidding Process:

Interested parties place a bond with the platform to indicate their interest in purchasing at the NYP.

- Decision Period:

Once a bond is placed by a bidder, you have 3 calendar days to decide whether to:

- Sell the Property at the original NYP.

- Pay a penalty (e.g., 20% of the NYP bond) and continue to own the Property.

- Receiving Payment:

If you accept the offer, you will receive the full NYP amount minus the transaction fee and the commission rate set by the platform at the time of transfer (e.g., 10% of the NYP bond).

- Third-Party Fees:

The platform will deduct any transaction fees charged by payment gateways and any applicable tax withholdings from the NYP amount before it is disbursed to you.

- Keeping the Property:

If you decide to keep the Property by paying the penalty, the bidder will receive a full refund of their NYP bond.

- Penalty Distribution:

The penalty paid by the original owner will be split 50/50 between the platform and the bidder.

- Third-Party Fees:

The platform will handle any transaction fees charged by payment gateways and any applicable tax withholdings from the penalty amount before distribution.

aaa

Fly-Sign

.png)

.jpg)

.png)

.jpg)

10 Votes

10 Votes

13 Comments

13 Comments

Hide r/Starlink

Hide r/Starlink

-2.png?width=1072&upscale=true&name=image%20(9)-2.png)

-1.png)

_01HRDNZKBWABAF39T30P6NHK28.png)

-(1).png)

_01H6XQAS0CHV7C235J1H3DCZS7.png)