In 1998, Yahoo was approached by two founders. They wanted to sell their business to Yahoo. The two founders were asking for $1 million. People who followed the internet’s early days know about this deal. The two founders were Larry Page and Sergey Brin. Their company – Google. Yahoo refused. Yahoo was a search engine. It helped people find things on the internet. Google was an early competitor. Back then, Google was not known. Yahoo was well known in the search engine industry. There were a few other companies too. Now we know well, things did not go well for Yahoo. It kept losing market share and was eventually acquired. But let’s talk about that later. Yahoo was founded in 1994 and till about 2000, it was a leader in the internet industry. After that, Google proved to be a fantastic search engine. Yahoo started losing ground. Google was still a tiny company. Yahoo was much larger. Yahoo decided to make an attempt to acquire Google. In 2002, it offered $3 billion to buy its competitor.

Google refused. They knew they had the upper hand. About then, competition got too tough for Yahoo. It was being outrun by its competitors that included companies like Google and later, Facebook. In 2005, Yahoo invested a massive $1 billion in Alibaba for a 40% stake. In 2006, it was in talks with Facebook – to acquire it for $1 billion. Facebook was only 2 years old. But was a very fast-growing company. The deal failed. Since then, Facebook has done exceedingly well. Yahoo’s search engine business continued to lose market share. Still, the company invested in a few start ups throughout its journey. In 2008, Microsoft offered to acquire Yahoo for $46 billion. Yahoo felt it was worth a lot more. So the deal did not happen. In 2017, Yahoo was ultimately acquired by Verizon (a telecommunications company in the US) – for only $5 billion. Loeb’s move In 2011, a New York based hedge fund, called Third Point, made an announcement. They said they had been buying shares of Yahoo; and that they owned 5.2% of the company. The manager of the hedge fund, Dan Loeb, released a letter explaining why he had bought so many shares of Yahoo. This was a world where companies like Google and Facebook were grabbing everyone’s headlines. Very few people spoke about Yahoo. And why would they? Yahoo’s market share was declining. It seemed like a company that had nothing to offer. So, why did Dan Loeb buy so many Yahoo shares? Because Yahoo had a stake in Alibaba. And also in Yahoo Japan. Alibaba Jack Ma started Alibaba in 1999. It was first touted as China’s Amazon.com. As it expanded its offerings, it came to cover a lot more than just online shopping. Alibaba’s offerings ranged from e-commerce solutions for wholesalers, retailers, exporters, etc. It even offered services beyond e-commerce: payments, cloud services, supply chain, etc. But in 2005, it was not a strong brand. At least not back then. This is when they had sold a 40% stake to Yahoo – for $1 billion. They needed the money. The following years, Alibaba grew stronger. Its brands became household names. All of this was in China – the world’s most populous country (back then). In 2011, Alibaba’s business had grown to immense heights. And it planned to IPO in the USA soon. Alibaba dominated the markets it operated in. So much so, many times, the next biggest competitor of Alibaba would be 4-5 times smaller. Alibaba had a market share of around 50% or more in the B2B, C2C, and B2C space. To top that, it had around 50% market share of the payment industry (Alipay), and a few other ancillary products. Alibaba was a giant. And – Yahoo owned 40% of this giant. But somehow, no big investor seemed to have noticed this. There was one more hidden factor. Yahoo was not doing well. But Yahoo Japan (a joint venture between Yahoo and SoftBank) was doing very well. For a long time, Yahoo Japan dominated the Japanese internet market with various offerings. It seemed like everyone was looking at Yahoo’s own business – and ignoring the Alibaba stake and Yahoo Japan. To Dan Loeb, the Yahoo stock price appeared very underpriced. He wanted to seize the opportunity. He bought 5.2% of the company. Activist Investor In 2011, after making his stake in Yahoo public, Dan Loeb turned his focus on the Yahoo management. An investor buys shares of a company and watches the management of the company run the show. An activist investor does not just sit and watch. An activist investor intervenes and tries to change the company. This is obviously not possible for smaller investors. But big investors who own large parts of a company can do this. Dan wrote a letter to the Yahoo board accusing them of not running the company well. He wanted a change. It led to quite an uproar. Lots of back and forth took place between the board and Dan. Eventually, he got his way. The CEO stepped down and a new CEO was hired. Many board members also left and new board members were appointed. Dan Loeb Exits In 2011, he had bought the shares at a price of around $13 per share. In 2013, Dan Loeb sold majority of his Yahoo stocks and exited the company. He sold his shares for around $29 – he doubled his investment in only 2 years. Before tax, he made a total of $610 million profit. This incident is a good lesson in the discovery of information. Investors tend to think that big institutional investors would have researched everything. But as this story demonstrates, they do not research everything. Even a big company like Yahoo is not fully scrutinized. Until Dan Loeb found it, nobody was talking about the massive Alibaba stake and the Japan business. Not everything worth knowing is already known to all. Investors who are able to find such information are able to position themselves to gain from it. A lot happened after Dan Loeb’s exit. Alibaba’s IPO took place in 2014. Yahoo was acquired in 2017. But those are all stories for another time. For now, the lesson remains this: research can provide an edge to investors. The images above were generated using AI tools.

🔢 Quick Takes +India’s forex reserves rose to an all-time high of $704.89 billion after adding $12.59 billion in the week that ended on 27 Sept. +India’s services sector PMI fell to 57.70 in Sept (vs 60.90 in Aug). The services sector grew at a slower rate in Sept as compared to Aug. +India’s housing sales in 8 major cities rose 5% year-on-year to 87,108 units in the July-Sept quarter. Mumbai saw the highest sales at 24,222 units. Kolkata saw the highest growth rate of 14%, while NCR saw a decline of 7%: Knight Frank report. +KRN Heat Exchanger IPO got listed at a 118.18% premium. +Mankind Pharma received approval from CCI to acquire Bharat Serums and Vaccines for Rs 13,630 crore. +The government launched a new EV subsidy scheme, PM E-DRIVE, to increase EV adoption in India. The scheme has been allocated Rs 10,900 crore to give subsidies based on EVs' battery power and to increase EV charging stations. +India’s GST collection rose 6.5% year-on-year in Sept to Rs 1.73 lakh crore.+UPI transactions rose 31% year-on-year to Rs 20.64 lakh crore in Sept (vs 20.61 lakh crore in Aug). Average daily transactions rose to Rs 68,800 crore: NPCI. +Air India has completed the merger of its low-cost airlines Air India Express and AIX Connect (formerly Air Asia) under the name 'Air India Express'. +Trent and Bharat Electronics are now a part of Nifty 50. Divi's Lab and LTIMindtree have been removed from Nifty 50, as part of a regular reshuffle. +India’s current account deficit rose to 1.1% of GDP in the April-June 2024 quarter. It was 1% of GDP in April-June 2023.

Groww Digest on Telegram: Click here to subscribe.

📊 Markets this week

| MON | TUE | WED | THU | FRI | | 25811 | 25797

| HOLIDAY | 25250 | 25015 | ▼ 1.41%

| ▼ 0.05%

| -

| ▼ 2.12%

| ▼ 0.93%

|

How markets compare to the previous week's end: | SENSEX 🇮🇳 | 81,688.45 | ▼ 4.54%

| | NIFTY 🇮🇳 | 25,014.60 | ▼ 4.45%

| | GOLD 🥇 | Rs 76,110 | ▲ 1.17%

| | SILVER 🥈 | Rs 92,420 | ▲ 0.76%

| | DOW JONES 🇺🇸 | 42,352.75 | ▲ 0.42%

| | NASDAQ 🇺🇸 | 18,137.85 | ▼ 0.29%

|

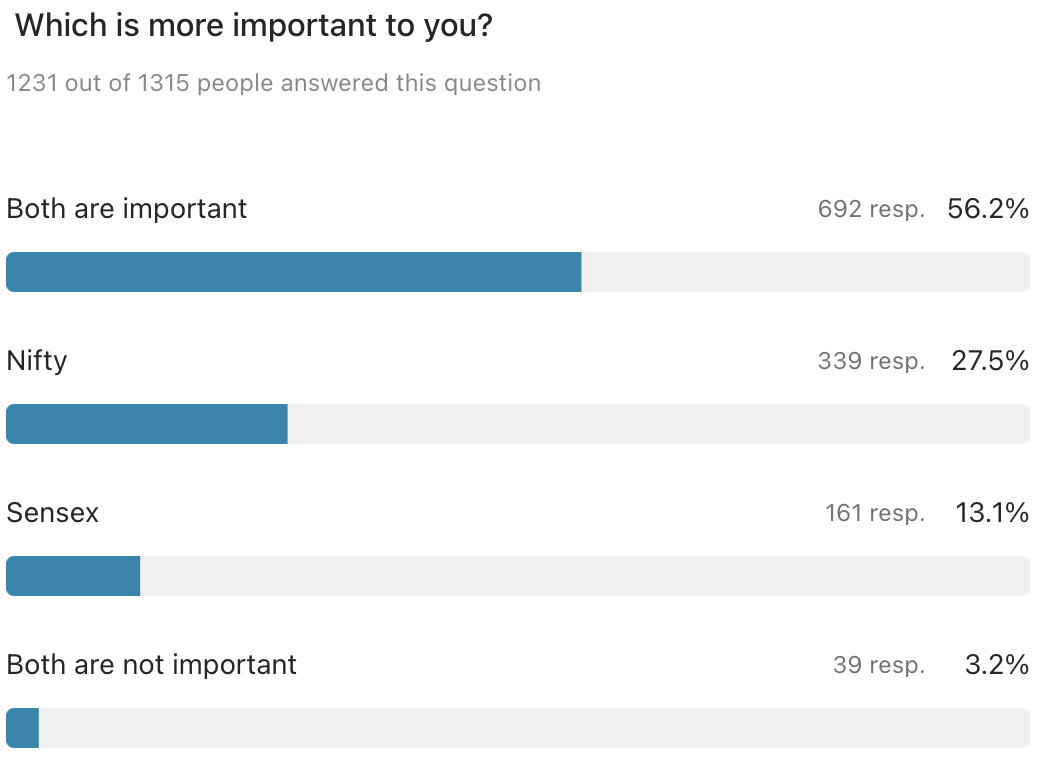

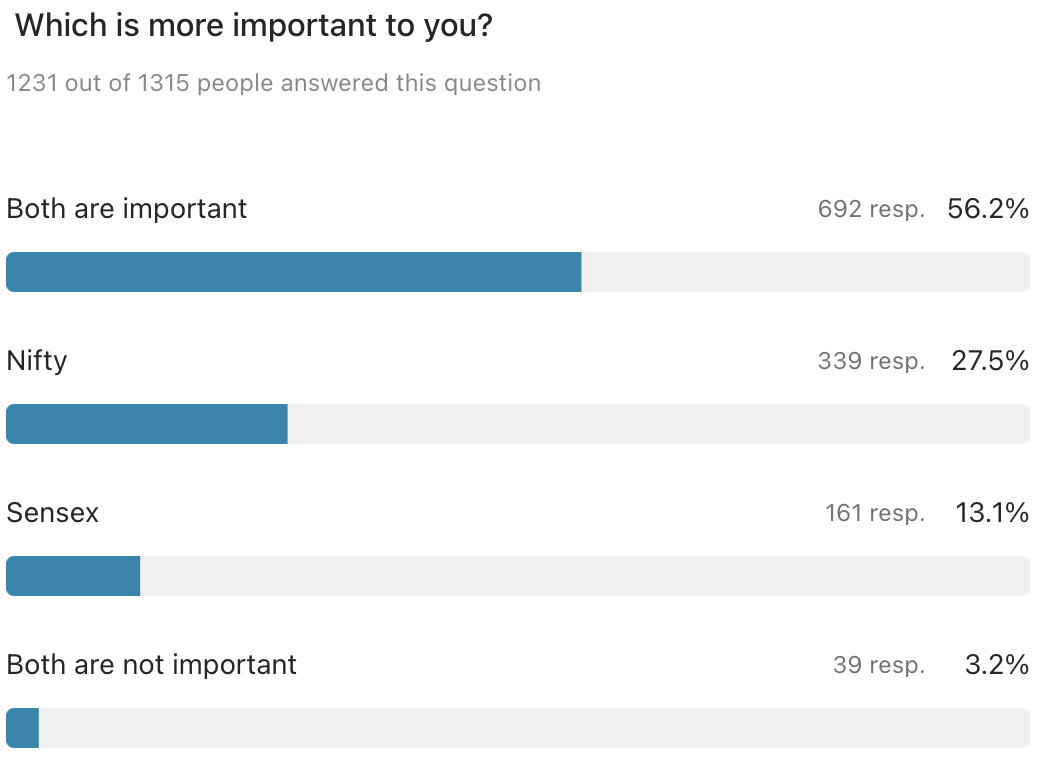

What are Sensex and Nifty?

፧ Quick Poll How many smartphones do you have?

-Zero

-One

-Two

-Three or more ANSWER HERE

6-Day-Course

Theme: less popular types of equity mutual funds We’ve reached the end of this week’s course that started on Monday. Here’s a test you should take. Get pen and paper! Question 1:

____________ mutual funds try to generate maximum returns by avoiding over-diversification and investing on maximum of 30 stocks.

-Large-cap

-Focused

-Contra

Question 2:

Some mutual funds try to find good companies opposite to the current market trend. These funds are known as ____________ funds.

-Thematic

-Flexi-cap

-Contra

Question 3:

Sectoral mutual funds invest in companies belonging to a particular sector, like banking, metal, etc.

-True

-False Question 4:

Investing in stocks that are currently priced lower than their actual worth, and gaining from their higher future price is done by _____________ funds.

-Thematic

-Value

Question 5:

Mutual funds that have to invest at least 25% in small-cap stocks, 25% in mid-cap stocks, and 25% in large-cap stocks are known as multi-cap funds.

-True

-False

Answers:

Q1: Focused

Q2: Contra

Q3: True

Q4: Value

Q5: True

Missed this week's course? You can download the course PDF - click to download. Missed the previous days of this 6-day course? We sent the emails to you. Just search 'Groww Digest' in your email's search box.

Did you enjoy this issue?

The information contained in this Groww Digest is purely for knowledge. This Groww Digest does not contain any recommendations or advice.

That's it for now. See you next week!  | Investing made simple 📈

Team Groww Digest |

|